CHIC Shanghai - THE MOTTO 'NEW MAKERS' INTERPRETS THE PROGRESSIVE CHANGE IN THE CHINESE FASHION BUSINESS

- The important trade fair platform for entry into the Chinese consumer market with China's most influential consumer group for the fashion and beauty sector with the strongest growth in consumption - the millennials - as target group

- The international fashion showcase for decision makers with an overview of na-tional and international fashion brands

- Strategic market development through comprehensive visitor marketing for inter-national brands at CHIC

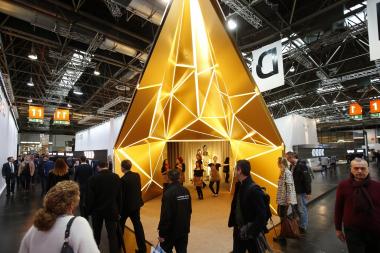

CHIC, China International Fashion Fair presents around 800 exhibitors in an exhibition space of approx. 50,000 sqm (CHIC in March 100,000 sqm) in two halls from 27 to 29 September 2018 at the National Exhibition & Convention Center in Shanghai.

The current conditions for international fashion companies in the Chinese market offer significant improvements for international brands. Import tariffs will be lowered from 15.9% to 7.1% to further promote the import and upgrade of the industry.

The McKinsey study "THE `Chinese consumer´ no longer exists” defines Chinese consumers no longer as interested only in low prices, but as selective, healthconscious with diverse shopping hab-its and preferences. The fashion awareness changes to an individual sense of style, influenced by international and national trends. China's millennials are the WORLD'S most influential consumer group, with a 16% share of the population, driving consumption growth in the Chinese market and contributing more than 20% from today until 2030.

According to the edition's motto "New Makers", Asia's leading fashion fair is picking up on the latest changes in the Chinese fashion market and providing the essential tools for the Chinese market. The new, young design of the fair, which was launched in March this year at CHIC, is being ex-panded. The individual sections of CHIC present the latest trends in the Chinese and international fashion market. CHIC connects and brokers partnerships and launches the new generation gar-ment industry, which builds on high-tech strategies and interlinks industrial production with modern information and communication technologies, relying on intelligent, digitally networked systems in self-organized production.

The individual fashion areas of CHIC

FASHION JOURNEY puts the focus on interna-tional exhibitors. In addition to the large Italian pavilion, the French pavilion "Paris Forever" and the Korean show-inshow "Preview in China", in-dividual participants from Poland, the UK, France, Italy, Spain, Japan and the USA use CHIC as a bridge in the Chinese market. The next German group participation is planned for March 2019, whereby Germany will also be rep-resented with individual brands such as ESISTO in the area NEW LOOK.

IMPULSES, CHIC's designer section, features emerging designer brands such as Junne, Hua Mu Shen, King Ping, Anjaylia, Mao Mart homme, Tuffcan, etc.

The SUSTAINABILITY ZONE, first showcased at CHIC in the fall of 2017, is receiving even greater emphasis due to the increasing environmental and health awareness of Chinese consum-ers, featuring sustainable supply chain solutions, sustainable innovation and sustainable fashion collections. Programs such as Chemical Stewardship 2020, Carbon Stewardship 2020, Water Stewardship 2020 and Circular Stewardship 2020 are presented. The womenswear section NEW LOOK of CHIC presents next to the leading Chinese brands like AVRALA, and CMH also international brands like Saint James from France, ESISTO from Ger-many, Trenz Eight from Canada or PN JONE, USA.

Beside the suppliers of classic menswear, URBAN VIEW, the menswear section, also includes casualwear brands like NRDMA and SUPIN as well as bespoke companies like H. Pin& Tack, Jin Yuan Yang, Fa Lan Qian Mu, Long Sheng and DANDINGHE.

CHIC YOUNG BLOOD shows young lifestyle brands, KID'S PARADISE offers e.g the largest fashion group in China for children's fashion XTEP KIDS.

SECRET STARS (fashion accessories), SHANGHAI BAG (bags), HERITAGE (leather & fur), SUPERIOR FACTORY (ODM) and FUTURE LINK (services) complete the fashion offer at CHIC. FUTURE LINK gathers fashion service providers for among others supply chain solutions, smart retail and smart production, RFID, laser technology and data utilization.

Visitor management

On the rise in China's retail scene, multi brand and custom stores are the fastest growing offline sector. The number has increased significantly in the last five years from less than 100 to more than 5,000 stores. Exclusive shopping experiences and an individual offer are important. Custom-ers value a wide range of products: a mix of international and national exclusive brands is the most common concept.

The high investments of the CHIC organizers in the visi-tor management for the fair pay off: CHIC has a per-sonalized trade visitor database of over 200,000 con-tacts, which are used intensively for the visitor marketing in the run-up to the fair for a commercial matching for the exhibitors. At the fair, VIP match making activities will take place especially for selected international brands, that will have the opportunity to present them-selves there and make the relevant contacts in the Chi-nese trade. Meetings are organized among others with multi brand stores and buyers such as The Fashion Door, Dong Liang, Jing Dong, VIP Shop and department stores, and retailers such as Carrefour, Amazon, De-cathlon, Wang Fujing, etc. An important tool for the CHIC visitor marketing is social media; for this special programs are run, in which individual brands are pre-sented to prospective visitors.

CHIC is visited by representatives of all distribution channels for distribution in the Chinese market, at the last event in autumn 2017 more than 65,722 visitors from all over China and other nations were registered at the CHIC, with a significant increase in multi brand stores.

Seminars and shows

The future of fashion business in China will be discussed in a panel of experts as part of CHIC TALKS. Furthermore, a trend seminar from WGSN for FW 2019 and a workshop on bag and shoe production from the Moda Pelle Academy are planned.

CHIC shows provide an overview of selected international brands.

CHIC is organized by Beijing Fashion Expo. Co. ltd. and China World Exhibitions, supported by China National Garment Association, The Sub-Council of Textile Industry (CCPIT) and China World Trade Center.

CHIC, Messe, Asien Fashion Mode Fashion Expo internationale Modemarken China chinesischer Markt CHIC Fair

JANDALI MODE.MEDIEN.MESSEN