Rieter: Growth in Order Intake in the First Half of 2024

- Order intake of CHF 403.4 million in the first half of 2024, up 24% on the previous year period

- Sales of CHF 421.0 million 44% below first half of 2023

- Order backlog of around CHF 640 million at June 30, 2024

- EBIT of CHF 8.9 million and net result of CHF 1.7 million

- Significant cost reductions as a result of the “Next Level” performance program

- Outlook for the full year 2024 specified

In the first half of 2024, the Rieter Group posted an order intake of CHF 403.4 million (first half of 2023: CHF 325.0 million), which represents a significant increase of 24% compared with the same period of the previous year. Sales were CHF 421.0 million (first half of 2023: CHF 758.2 million). As expected, this was 44% lower than the previous year.

In a challenging business environment, Rieter achieved an EBIT margin of 2.1% thanks to strict cost management. The systematic implementation of the “Next Level” performance program led to a strengthening of profitability. Rieter recorded a profit at the EBIT level of CHF 8.9 million in the first half of 2024 (first half of 2023: CHF 25.2 million). The reduction of the cost base particularly in research and development as well as selling and administrative expenses contributed to this positive result.

Outlook for the full year 2024 specified

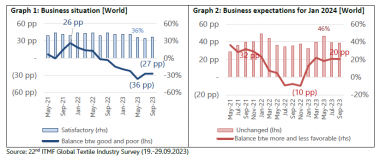

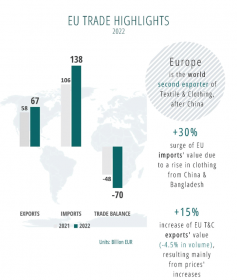

The markets remained under pressure from the economic slowdown, high inflation rates and noticeably dampened consumer sentiment. The first signs of a recovery in financial year 2024 have emerged in the key markets of China and India. Rieter expects demand to pick up further in the coming months.

For the full year 2024, Rieter anticipates sales in the range of CHF 900 million to CHF 1 billion and a positive EBIT margin of 2% to 4%.

Rieter AG