6 out of 10 consumers pay attention to sustainability criteria when shopping

ESG aspects are most important to consumers when it comes to food and clothing. Young people in particular demand information and transparency: sustainability labels, certifications and reports ensure trust. For retailers and manufacturers, sustainability is becoming a must.

Under what conditions are the cows kept whose milk I drink? Does the manufacturer of my new T-shirt tolerate child labor? Does the retailer I trust deal fairly with employees and business partners? The majority of Germans ask themselves questions like these before making a purchasing decision. When shopping, 59 percent of consumers always or at least frequently pay attention to the ecological, economic or social sustainability of retailers and manufacturers. Among those under 35, the figure is even hugher with two-thirds, and among those over 55, one in two. These are the findings of a representative survey of 1,000 people in Germany commissioned by the auditing and consulting firm PwC Germany.

Sustainability is no longer a question of "if", but "how".

"Sustainability has become mainstream in recent years. For companies, paying attention to sustainability in their supply chains has already become a must," comments Dr. Christian Wulff. The Head of Retail and Consumer Goods at PwC Germany is convinced that companies will already have to give good reasons in the near future if they do not pay attention to the environment, social aspects and good corporate governance when producing a product. "The issue of sustainability is therefore no longer a question of whether, but of how," the retail expert continues.

Sustainability includes various aspects in the three areas of environment, social and sustainable governance (ESG). In the case of environmental sustainability, the focus is on issues relating to animal welfare - such as the conditions in which animals are kept or animal testing - and the use of recyclable materials. 40 percent of Germans would like to be informed about this before making a purchase. In the social sphere, the majority of respondents would like to know whether retailers and manufacturers comply with human rights (58 percent) - for example, whether they tolerate forced or child labor in their value chains. In terms of governance, one in two respondents would like to know about supply chains and be able to trace products before making a purchase.

Sustainability is particularly important for food

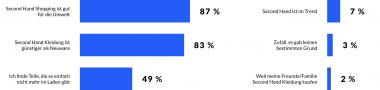

How closely consumers look at sustainability also depends on the product: For example, sustainability is particularly important to them when it comes to food. 81 percent of Germans pay attention to at least one of the three ESG criteria when buying food, i.e. environment, social issues or good corporate governance. But these criteria are also relevant when buying textiles: As many as 63 percent say they look at how sustainably the item was produced when buying clothing or shoes. While environmental aspects play the biggest role for food (62 percent), consumers are paying more attention to social aspects for clothing, shoes and accessories (52 percent).

Almost every second person has recently switched to sustainable products

The growing importance of ESG aspects in the purchasing behavior of German consumers is also evidenced by the shifts toward buying sustainable products. The trend toward sustainable products is clearest in the case of food: 45 percent of respondents state that they have consciously switched to more sustainable products within the past two years. By contrast, only 17 percent admit to switching (back) to less sustainable products, with one in three stating a lack of financial resources as the reason.

For just under half of those surveyed, a possible switch to more sustainable products would be supported by better availability in stationary retail. Legal regulations are also seen as helpful, both in terms of product labeling (38 percent) and for the production process (37 percent). More eye-catching product placement in stores would also help (37 percent).

Young people in particular demand transparency and education

Consumers' need for transparency in ESG matters is significant: According to the survey, almost three quarters of Germans obtain information about environmental sustainability issues at least occasionally. Two-thirds research aspects of social sustainability. A good half regularly find out about sustainable corporate governance.

Age has a major influence on how intensively people deal with the issue: While 80 percent of 16- to 24-year-olds find out about the environmental aspects of a product before buying it, only 59 percent of those over 65 do. "Younger people in particular are actively informing themselves and demanding transparency around ESG criteria," sums up Christian Wulff.

Consumers want information on packaging and online

To meet this need for information, the PwC expert advises manufacturers and retailers to provide detailed information about ESG aspects of products, especially online. "Keeping the associated, significantly increasing flood of data up to date at all times is increasingly becoming a challenge for companies that can only be solved by significant investments in new technologies."

Consumers agree on what companies can do to lend more credibility to their sustainability activities: A solid two-thirds consider recognized sustainability labels, certifications or independently audited sustainability reports to be suitable for credibly communicating activities in terms of ESG. "The results of our survey show that labels and independent certifications are very important in gaining the trust of customers. It is therefore worthwhile to have ESG measures confirmed by external organizations," says Christian Wulff.

Retailers and manufacturers should focus on transparency

"Manufacturers and retailers are faced with the task of ensuring a high level of transparency with regard to the sustainability of their products. This calls for honesty, but also creativity: In the case of fashion, for example, it is conceivable to trace the individual stages of the supply chain in detail and to show the costs incurred in the process. In this way, consumers can understand exactly how a price comes about," concludes Christian Wulff.

PwC / Textination