HEIMTEXTIL 2019: TRENDS IN A NEW GUISE

Heimtextil is pushing ahead with the new concept for 2019: now that those responsible have worked out a completely new hall plan, they are turning their attention to redesigning the trend programme. With a meeting of international trend researchers on 20 and 21 February in Frankfurt am Main, the design experts have begun preparations for the trends of the upcoming Heimtextil (8-11 January 2019) at an unprecedented early stage.

‘The Heimtextil trends have enjoyed a worldwide reputation for decades. Showcased in the extensive and progressive way that they are, they are an essential component of our trade fair’, says Olaf Schmidt, Vice President Textiles & Textile Technologies at Messe Frankfurt. ‘That's why it is very important to us that we continue to live up to our pioneering role with our new trend concept and offer our exhibitors and visitors a future-oriented programme. In the future, we will strengthen this showcasing above all at the digital level’.

Starting with the meeting in Frankfurt, trend researchers from three European offices are working on the Heimtextil trends 2019/20. The British design studio FranklinTill will once again play a leading role and is responsible for the implementation of the Trendbook. The Stijlinstituut Amsterdam (Netherlands) and SPOTT Trends & Business (Denmark) have joined forces with them to form the new Heimtextil Trend Council.

During the two-day workshop, the three agencies compiled insights into current trends in interior design, architecture, fashion and art. They focused on developments in materials and textures, colours and patterns. Finally, they defined stylistically formative design themes from which a globally applicable trend forecast will be worked out in the coming months.

New: “Trend Space” in hall 3.0

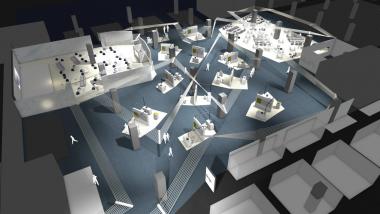

When it comes to showcasing trends at the trade fair, Heimtextil will receive support from the Frankfurt agency Atelier Markgraph. As a specialist for communication within spaces, Atelier Markgraph is planning an interactive, future-oriented exhibition that will immerse trade fair visitors in the world of trends 2019/2020 using analogue/digital experience formats. In future, the trend showcase will be called “Trend Space”, replacing the previous “Theme Park”. Those responsible for this change have chosen hall 3.0 as the new location. As part of the new Heimtextil concept, the “Trend Space” can be found in close proximity to international textile designers, CAD/CAM suppliers and digital printer manufacturers. Heimtextil is thus bringing the progressive themes of trends, textile design and digital printing together on one hall level, creating an area full of inspiration and future technologies. Hall 3.0 – exclusively for exhibitors – will be opened on the eve of Heimtextil on 7 January 2019.

Preview: Trend presentation in late summer

The results of the trend researchers will be recorded in the new Heimtextil Trendbook. Exhibitors at Heimtextil will be sent the Trendbook in advance to assist in their product design and collections. Together with the Trend Council, those responsible for the trade fair will provide an initial insight into the new trends on 4 September. For this purpose, Heimtextil will invite representatives of the press to a preview, the framework of which will also be redesigned.

The following design studios are working on Heimtextil 2019:

The design studio FranklinTill (United Kingdom) will be taking on the main responsibility for the development of the Heimtextil Trends 2019/2020. With its headquarters in London, the studio comprises trend researchers, designers and stylists as well as a broad-ranging, international network of creatives and visionaries. The multidisciplinary agency's varied projects include trend reports, colour forecasts, design realisations, brand developments and curating trade fairs and exhibitions. In addition to agency founders Kate Franklin and Caroline Till, Titia Dane will also be working on Heimtextil. www.franklintill.com

Anne Marie Commandeur from the Stijlinstituut Amsterdam (Netherlands) manages a team of designers who focus on textile innovations, predictions, colour trends and strategic design concepts. The agency acts as a versatile and dynamic force in the industry and keeps fashion companies and fashion-related companies up to date on the most important developments. This year, researcher Emma Wessel is supporting Anne Marie Commandeur at Heimtextil. www.stijlinstituut.nl

SPOTT Trends & Business (Denmark) advises Scandinavian lifestyle brands with issues relating to consumer insights, trend and colour forecasts. SPOTT aims at the individual development of brands and combines trend research with neuroscience and commercial expertise. Anja Bisgaard Gaede is the founder of SPOTT. In addition to her work as a consultant, she has given many presentations over the past ten years, and has also published a reference book. www.spottrends.dk

Atelier Markgraph (Germany) designs rooms that communicate and stimulate communication. For more than 30 years, the design studio has supported its clients in creating immersive experiences in the areas of conflict where culture, business and science intersect. At the interface of digital and analogue communication, a 60-strong interdisciplinary team translates central themes and brand messages into directly tangible scenarios: from exhibitions and showrooms to exhibition stands, media installations and AR applications. www.markgraph.de

© Messe Frankfurt GmbH / Pietro Sutera

© Messe Frankfurt GmbH / Pietro Sutera

© Messe Frankfurt GmbH / Pietro Sutera Der Trend Council (from left to right): Emma Wessel (Stijlinstituut Amsterdam), Anja Bisgaard Gaede (SPOTT trends + business), Anne Marie Commandeur (Stijlinstituut Amsterdam), Caroline Till und Titia Dane (FranklinTill Studio).

© Messe Frankfurt GmbH / Pietro Sutera Der Trend Council (from left to right): Emma Wessel (Stijlinstituut Amsterdam), Anja Bisgaard Gaede (SPOTT trends + business), Anne Marie Commandeur (Stijlinstituut Amsterdam), Caroline Till und Titia Dane (FranklinTill Studio).

© Messe Frankfurt GmbH / Pietro Sutera

© Messe Frankfurt GmbH / Pietro Sutera

Messe Frankfurt Exhibition GmbH