East German Textile and Clothing Industry recorded a significant Drop in Sales in 2020

- vti calls on health textiles purchasers to place more orders with domestic manufacturers

- East German textile and clothing industry faces the Covid-19 crises with new ideas and products

- Clothing sector more affected than the textile sector

The Association of the North-East German Textile and Clothing Industry (vti) calls on decision-makers in politics and authorities as well as in clinics and long-term care to order far more health protection textiles from local manufacturers than before. "That would be a logical step towards future-oriented, sustainable business - and furthermore in an exceptionally tough crisis situation. We are happy to arrange appropriate contacts with our companies," emphasized Dr.-Ing. Jenz Otto, Managing Director of the Chemnitz-based industry association, during an online press conference on January 8, 2021. “We don't understand the buying resistance concerning health textiles, even though the demand is huge. It is just as incomprehensible why there are still no noteworthy orders from authorities. In spring, the German federal government had already announced to provide 1 billion Euro with its economic stimulus package for national epidemic reserves for personal protective equipment. The federal states also had to take action in this regard and stock up. We urgently await the long-announced tenders for equipping the pandemic reserve stock. It is important that the purchase price is not the only measure of all things. Rather, criteria such as standard-compliant quality, traceable supply chains, the possibility of needs-based reorders and the multiple use of textiles are decisive for the safety of the population.”

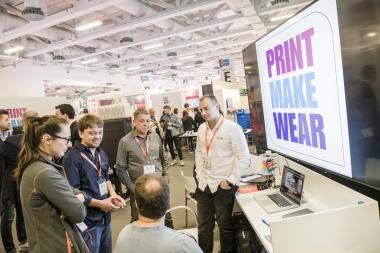

When supply chains worldwide collapsed at the beginning of 2020, both authorities and many care and health facilities turned to textile companies for help. Many manufacturers launched both everyday masks and protective textiles that could be used in healthcare at short notice.

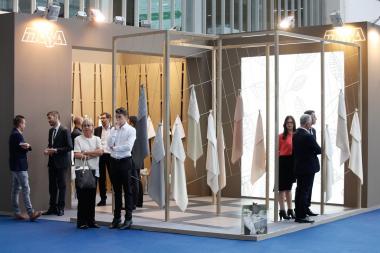

"These include highly effective bacteria and virus-repellent reusable products that enable effective textile management in the healthcare sector and at the same time prevent the piles of single-use waste from growing there," explained vti chairman Thomas Lindner, managing director of Strumpfwerk Lindner GmbH, Hohenstein-Ernstthal: “When the cheap imports from Asia reinstated, however, the interest decreased significantly. Nevertheless, numerous companies have continued to invest in new technology and aligned their production accordingly. For example, completely new production lines of face masks have been set up at several locations. Do not forget: The very expensive test procedures for medical and health textiles are a major challenge for us, the medium-sized businesses. In addition, there are still too few accredited test and certification bodies in Germany.” The fact that the companies were able to adapt to the new requirements at this rapid pace was primarily possible, because around 30 local companies and research institutes have been part of the health textiles network "health.textil", which is controlled by the vti and supported by the Free State of Saxony, for several years now. This alliance cooperates closely with practice partners such as the University Clinic of Dresden and the Elbland Clinics in Meißen. Nowadays it has expanded their activities to their neighbouring industry, research and application partner in Czech Republic. www.healthtextil.de

CO2 taxation puts medium-sized companies at a competitive disadvantage

Concerning the permanently relevant topic energy transition in Germany, vti General Manager Dr.-Ing. Jenz Otto points out that the economic framework conditions for medium-sized producers will continue to worsen with the introduction of the CO2 taxation in the midst of the current crisis. “The financial resources to be used for this will then be lacking for investments in innovative products and environmentally friendly manufacturing processes. Furthermore, our companies suffer significant competitive disadvantages compared to foreign competitors.” Björn-Olaf Dröge, managing director of the textile finishing company pro4tex GmbH, Niederfrohna, with around 100 employees, reported that the tax to be paid by his company for renewable energies adds up to around a quarter of a million euros annually. “Now the CO2 taxation for our natural gas consumption comes on top of that. For 2021 we anticipate an additional burden of almost 70,000 Euros.”

vti about the current situation in the East German industry

The East German textile and clothing industry recorded a significant loss in sales already in 2019. This trend has continued in 2020 being reinforced by the Covid-19 crises. Based on preliminary estimates, the vti assumes that the total turnover of the industry will be more than 11 percent below the previous year at the end of 2020, where the clothing sector is affected far more than the textile sector, with a decline of 35 percent. Exports, which are extremely important for the industry, also decreased in a similar magnitude. The job cuts have so far been relatively moderate, as many companies use the short-time working regulations and try to retain their permanent workforce. For 2021 the vti sees a gleam of hope in technical textiles, which have been in greater demand again in recent weeks - especially from the automotive industry. The employment cuts have so far been relatively moderate, as many companies use short-time working regulations and try to retain their permanent workforce. The vti sees a bright future for technical textiles in 2021, which have been in greater demand – especially in the automobile industry – in the last few weeks.

Of the around 16,000 employees, 12,000 work in Saxony and 2,500 in Thuringia. This makes this region one of the four largest German textile locations, along North Rhine-Westphalia, Baden-Württemberg and Bavaria. It has modern spinning mills, weaving mills, knitting mills, warp knitting mills, nonwovens manufacturers, embroidery mills, finishing companies and clothing manufacturers as well as efficient research and educational institutions.

Over half of the turnover in the East German textile and clothing industry has so far been attributa-ble to technical textiles, followed by home textiles with around 30 percent and the clothing sector with around 10 percent. The vti acts as a stakeholder at state, federal and EU level, tariff- and so-cial partner, as well as a service provider for its around 160 member companies.

vti East Germany Association of the North-East German Textile and Clothing Industry

Association of the North-East German Textile and Clothing Industry