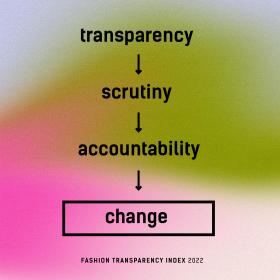

Results of the FASHION TRANSPARENCY INDEX 2022

The world’s largest fashion brands and retailers must increase transparency to tackle the climate crisis and social inequality, according to the latest Fashion Transparency Index.

The seventh edition of the Fashion Transparency Index ranks 250 of the world’s largest fashion brands and retailers based on their public disclosure of human rights and environmental policies, practices, and impacts, across their operations and supply chains.

- Brands achieved an average score of just 24%, with nearly a third of brands scoring less than 10%

- The majority of brands (85%) do not disclose their annual production volumes despite mounting evidence of clothing waste around the world

- Most major brands and retailers (96%) do not publish the number of workers in their supply chain paid a living wage

The Index reveals insights into the most pressing issues facing the fashion industry, like:

- As new and proposed legislation focuses on greenwashing claims, almost half of major brands (45%) publish targets on sustainable materials yet only 37% provide information on what constitutes a sustainable material.

- Only 24% of major brands disclose how they minimise the impacts of microfibres despite textiles being the largest source of microplastics in the ocean.

- The vast majority of major brands and retailers (94%) do not disclose the number of workers in their supply chains who are paying recruitment fees. This paints an unclear picture of the risks of forced labour as workers may be getting into crippling debt to accept jobs paying poverty wages.

- While many brands use their channels to talk about social justice, they need to go beyond lip service. Just 8% of brands publish their actions on racial and ethnic equality in their supply chains.

Despite these results, Fashion Revolution is encouraged by increasing supply chain transparency among many major brands, primarily with first-tier manufacturers where the final stage of production occurs, e.g. cutting, sewing, finishing and packing. Nine brands have disclosed their first-tier manufacturers for the first time this year. It is encouraging to see significant progress across market segments including luxury, sportswear, footwear and accessories and across different geographies.

Fashion Revolution’s co-founder and Global Operations Director Carry Somers says: “In 2016, only 5 out of 40 major brands (12.5%) disclosed their suppliers. Seven years later, 121 out of 250 major brands (48%) disclose their suppliers. This clearly demonstrates how the Index incentivises transparency but it also shows that brands really are listening to the millions of people around the world who keep asking them #WhoMadeMyClothes? Our power is in our persistence.”

More key findings from the Fashion Transparency Index 2022:

Progress on transparency in the global fashion industry is still too slow among 250 of the world’s largest fashion brands and retailers, with brands achieving an overall average score of just 24%, up 1% from last year

For another year, the initiative has seen major brands and retailers publicly disclose the most information about their policies, commitments and processes on human rights and environmental topics and significantly less about the results, outcomes and impacts of their efforts.

Most (85%) major brands still do not disclose their annual production volumes despite mounting evidence of overproduction and clothing waste

Thousands of tonnes of clothing waste are found globally. However, brands have disclosed more information about the circular solutions they are developing (28%) than on the actual volumes of pre- (10%) and post-production waste they produce (8%). Brands have sat by as waste importing countries foot the bill, resulting in serious human rights and environmental implications.

Just 11% of brands publish a responsible purchasing code of conduct indicating that most are still reluctant to disclose how their purchasing practices could be affecting suppliers and workers

Greater transparency on how brands interact with their suppliers ought to be a first step towards eliminating harmful practices and promoting fair purchasing practices. The poor performance on transparency in this vital area is a missed opportunity for brands to demonstrate they are serious about addressing the root causes of harmful working conditions, including the instances where they themselves are the key driver.

Despite the urgency of the climate crisis, less than a third of major brands disclose a decarbonisation target covering their entire supply chain which is verified by the Science-Based Targets Initiative

Many brands and retailers rely heavily on garment producing countries that are vulnerable to the impacts of the climate crisis, yet our research shows that only 29% of major brands and retailers publish a decarbonisation target covering their operations and supply chain which is verified by the Science Based Targets Initiative.

Only 11% of brands publish their supplier wastewater test results, despite the textile industry being a leading contributor to water pollution

The fashion industry is a major contributor to water pollution and one of the most water intensive industries on the planet. Only 11% of major brands publish their wastewater test result, and only 25% of brands disclose the process of conducting water-related risk assessments in their supply chain. Transparency on wastewater test results is key to ensuring that brands are held accountable for their potentially devastating impacts on local biodiversity, garment workers and their communities.

Most major brands and retailers (96%) do not publish the number of workers in their supply chain paid a living wage nor do they disclose if they isolate labour costs

Insufficient progress is being made by most brands towards ensuring that the workers in their supply chain are paid enough to cover their basic needs and put aside some discretionary income. Just 27% of brands disclose their approach to achieving living wages for supply chain workers and 96% do not publish the number of workers in their supply chain paid a living wage. In response, we have joined forces with allies across civil society to launch Good Clothes, Fair Pay. The campaign demands groundbreaking living wage legislation across the garment, textile and footwear sector.

Fashion Revolution