ITM Istanbul with strong VDMA participation

ITM, to be held in Istanbul at the beginning of June, will once again see a strong participation of VDMA member companies. Almost 90 exhibitors from Germany will exhibit at the trade fair, most of whom are members of the VDMA. In addition to the VDMA member companies exhibiting with their own booth, numerous VDMA members will be represented in Istanbul via agents. They cover nearly all different machinery chapters with a focus on spinning, nonwovens, weaving, knitting, warp knitting and finishing.

In Istanbul, the VDMA members will show their latest innovations. In technological terms, significant trends are digitalisation and automation. These themes have been present for some time but will continue to play a central role in meeting the challenges for many years to come. Another trend that has also been around for a while is sustainability. Today it is much more than a buzzword: Efficiency in energy, raw materials or water as well as recycling are not feel-good issues but have a real economic and social background.

For the textile machinery manufacturers organised in the VDMA, Turkey is a major trading partner. In 2023, textile machinery and accessories worth approximately 350 million euros were exported from Germany to Turkey, which made Turkey the second biggest sales market for German companies. After three years in which China was the most important supplier of textile machinery to Turkey, Germany has now regained this top position.

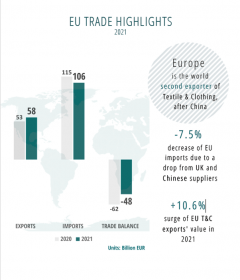

Turkey is at the doorstep of Europe, which gives Turkish textile producers a powerful geographic advantage over Asian sourcing destinations. The textile companies in the region have a deep experience and know-how in making the highest quality textile and apparel for leading markets of Europe and employs a young, dynamic, and well-educated workforce.

But ITM is not just a place for visitors from Turkey, as Dr. Harald Weber, Managing Director of the VDMA Textile Machinery Association explains: “It should not be forgotten that ITM not only attracts visitors from Turkey, but also from the Middle East, Central Asia and North Africa. Turkey's proximity to the European Union and its fully integrated textile value chain also make it interesting in terms of the EU's strategy for sustainable and circular textiles and the increasing importance of recycling in the future.”

VDMA e. V.

Textile Machinery