Lectra: Annual financial results of 2022

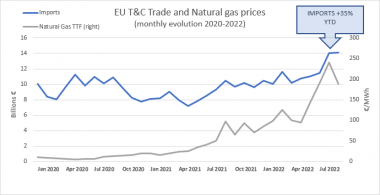

- Revenues: 521.9 million euros (+35%)

- EBITDA before non-recurring items: 98.4 million euros (+51%)

- Net income: 43.8 million euros (+55%)

- Free cash flow before non-recurring items: 43.7 million euros

- Dividend*: €0.48 per share (+33%)

Lectra’s Board of Directors, chaired by Daniel Harari, reviewed the consolidated financial statements for the fiscal year 2022. Audit procedures have been performed by the Statutory Auditors. The certification report will be issued at the end of the Board of Director’s meeting of February 23, 2023.

To facilitate the analysis of the Group’s results, the financial statements are compared to those published in 2021 and to the 2021 pro forma financial statement (“2021 Pro forma”), prepared by integrating the three acquisitions made in 2021 – Gerber Technology (“Gerber”), Neteven, and Gemini CAD Systems (“Gemini”) – as if they had been consolidated from January 1, 2021, whereas they have been consolidated since June 1, July 28 and September 27, 2021 respectively.

See attached document for full report.

Lectra