Lectra insources cutting equipment production in China

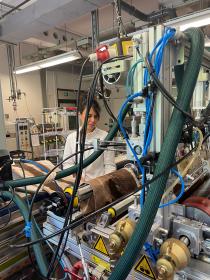

Lectra will now directly manage the production of its cutting equipment manufactured in China, primarily dedicated to its Asian customers. The Suzhou site, located to the west of Shanghai, will thus benefit from the standards of operational excellence already implemented by Lectra at its two other plants in Bordeaux-Cestas, France, and Tolland, USA.

Lectra's teams have over 35 years’ experience in the Asia-Pacific region, which in 2022 generated 25% of the Group's revenues.

Since the acquisition of its competitor, Gerber Technology, in 2021, Lectra had been relying on a plant belonging to Dutch group VDL Groep (VDL), to manufacture Gerber-brand multi-ply cutters and spreaders.

For its industrial activities, Lectra aimed to adopt the same standards of operational excellence in China as those currently in effect at its Bordeaux-Cestas and Tolland sites. The Group therefore created a new subsidiary, Suzhou Lectra Equipment Manufacturing Co. Ltd., to take over from subcontractor VDL as of December 1, 2023.

Following the takeover of in-house production at the Tolland site in October 2022, the creation of the Suzhou Lectra Equipment Manufacturing Co. Ltd. subsidiary marks a new milestone in the deployment of Lectra's industrial excellence strategy on a global scale. The Group intends to give priority to regional industrial production, which is beneficial to the local economy.

Lectra