Lenzing Group with substantial earnings increase in the first nine months of 2017

- Revenue up 9.4 percent to EUR 1,726.6 mn

- EBITDA improvement of 23.9 percent to EUR 397.1 mn

- Retail bond of EUR 120 mn redeemed – Lenzing with net liquidity as at end of September

- State-of-the-art application innovation center opened in Hong Kong

Lenzing – The Lenzing Group generated a substantial increase in revenue and earnings in the first nine months of the 2017 financial year compared to the prior-year period. The company is continuing the implementation of its Group strategy sCore TEN in order to further expand the offering of specialty fibers and be even closer to its customers and business partners.

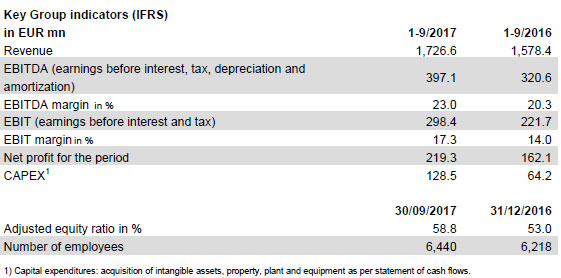

Consolidated revenue climbed 9.4 percent year-on-year to EUR 1,726.6 mn. This increase is mainly attributable to higher prices for all three fiber generations. Consolidated earnings before tax, depreciation and amortization (EBITDA) rose 23.9 percent to EUR 397.1 mn, corresponding to an EBITDA margin of 23 percent, up from 20.3 percent in the prior-year period. Earnings before interest and tax (EBIT) increased by 34.6 percent to EUR 298.4 mn, resulting in a higher EBIT margin of 17.3 percent (Q1-3 2016: 14 percent). The profit for the period improved by 35.3 percent to EUR 219.3 mn, and earnings per share rose 36 percent to EUR 8.12 per share. In September Lenzing redeemed the retail bond of EUR 120 mn. At the end of the reporting period the Group had net liquidity of EUR 16.9 mn.

“In the first three quarters of 2017, we successfully captured value in a very positive market environment and we continue to implement the sCore TEN strategy with great discipline. The opening of our new application innovation center in Hong Kong is an important step to boost our regional innovation capabilities. We were particularly proud to launch TENCELTM Luxe as a sign of Lenzing’s ongoing commitment to innovation and sustainability”, states Stefan Doboczky, Chief Executive Officer of the Lenzing Group. “After three excellent quarters we are confident to deliver substantially better operating results in 2017 compared to 2016, but at the same time we do expect more headwinds in 2018.”

Focus on customer intimacy

In September 2017, the Lenzing Group opened a new application innovation center (AIC) in Hong Kong, thus setting a further milestone in strengthening its innovation offering to all partners along the value chain. New applications for Lenzing fibers will be developed and tested at the new facility, among them applications for recent innovations such as the TENCELTM Luxe branded lyocell filament, the RefibraTM branded lyocell fiber and the EcoVeroTM branded viscose fiber.

Furthermore, new sales and marketing offices were opened in Turkey and South Korea in the first half of 2017. The direct contact to customers and well-equipped showrooms featuring products made of LenzingTM fibers serve as the basis for providing even better customer support.

Investment program in progress

The Lenzing Group aims to increase the share of specialty fibers as a percentage of revenue to 50 percent by 2020. Following the capacity expansion initiatives in Heiligenkreuz (Austria) and Mobile, Alabama (USA) which are both underway, Lenzing announced its intention to construct the next plant to produce TENCEL® fibers in Thailand.

A new era of sustainable production

In October 2017, the Lenzing Group presented a new product, TENCELTM Luxe, at an exclusive event held in Paris. The TENCELTM Luxe branded filament yarn represents Lenzing’s entry in the filament market. This fiber will support the Lenzing Group’s path towards becoming a true specialty player in the market for botanic materials derived from the sustainable raw material wood.

The launch volumes of TENCELTM Luxe are being produced at the Lenzing site. The basic engineering for a commercial scale plant was commenced.

Outlook

Demand development on the global fiber market remains positive within the context of a generally friendly macroeconomic environment. Lenzing expects wood-based cellulose fibers to grow at an even higher rate than the overall fiber market. After three excellent quarters, the Lenzing Group will achieve an operating result in 2017 that is significantly better than 2016.

For 2018, Lenzing sees a number of somewhat opposing factors that limit visibility regarding fiber price developments. Overall market demand is expected to remain high. However, the Group expects a substantial increase on the supply side, especially for viscose but also for cotton. Price trends for selected key raw materials, especially caustic soda, are difficult to predict. Against this background the Lenzing Group expects a much more challenging market environment for standard viscose during the upcoming quarters.

The above-mentioned development reassures the Lenzing Group in its chosen corporate strategy sCore TEN. The Group initiated its transformation from a volume-oriented viscose player to a value-oriented specialty fiber player at the end of 2015, and will continue the disciplined implementation of its business strategy.

The Lenzing Group