Third edition of Istanbul Fashion Connection in 2023

From February 8th to 11th, 2023, the third edition of IFCO, Istanbul Fashion Connection will take place in the Istanbul Exhibition Center.

The fair with over 600 exhibitors in 9 halls gives an overview of the new collections in the areas of womenswear, menswear, kidswear, denim, shoes, leather & furs. Separate platforms at IFCO are LinExpo for lingerie and hosiery and FashionIST with a wide range of wedding dresses, evening wear and suits. IFCO Sourcing, a new area at IFCO, offers the opportunity to find numerous companies for sourcing capacities.

Also new is the partnership with Igedo Exhibitions, Düsseldorf, which is responsible for the EUROPEAN SELECTION area at IFCO. International fashion labels present themselves at the fair as part of this participation.

More than 25,000 visitors from over 100 nations from all sales channels, from department stores and boutiques to online platforms from Eastern Europe, the Central Asian markets and the Arabian Gulf region, alongside buyers from Türkiye are expected at the show.

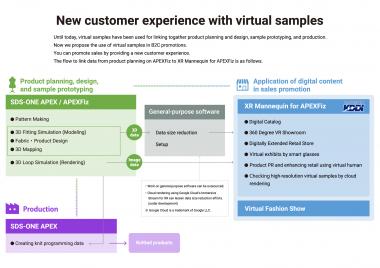

The declared goal of the organizers is to offer a "one-stop shopping solution" with IFCO that shows the creativity of the Turkish fashion scene, enables access to new sales markets and at the same time establishes the connection to potential production partners for supply chain optimization. The competitive advantages of production in Türkiye are evident:

short delivery times, high production quality, young and well-trained employees, the possibility of small minimum order quantities, a vertical textile and clothing industry that allows "one-stop shopping".

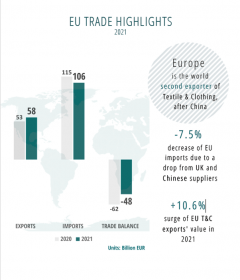

The manufacturing sector is an important sector for the industry, with over 80% of companies in Türkiye engaged in this sector. Türkiye has the fastest economic growth among the G20 after Saudi Arabia at 7.6% year-on-year in the second quarter of 2022, according to the Turkish Statistics Authority. Export is one of the most important pillars of growth.

The trade fair concept is being supported by the government with several programs. These include the cooperation with IMA, Istanbul ModaAkademisi, which regularly produces design talents becoming an integral part of the international fashion scene. IMA was founded in 2007 by ITKIB / IHKIB with the help of the IPA I program ((IPA: Instrument for Pre Accession Funds, provided by the EU for the EU candidate countries). Young design talents are brought to the stage at IFCO in cooperation with the ‘’Koza Young Fashion Designers Contest’’.