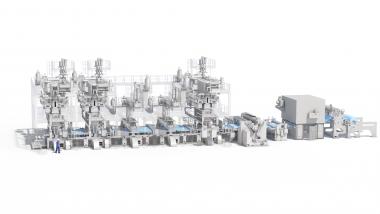

Rieter publishes Investor Update 2022

- Sales of CHF 366.8 million in the third quarter, CHF 987.4 million after nine months

- Order intake of CHF 226.4 million in the third quarter, CHF 1 095.8 million after nine months

- Order backlog of around CHF 2 000 million as of September 30, 2022

- Precautionary measures taken against potential energy crisis in Europe

- Financing of a Professorship for Artificial Intelligence

- Rieter site sales process on schedule

- Outlook 2022

Rieter recorded a significant increase in sales in the third quarter of 2022, reaching a level of CHF 366.8 million (2021: CHF 257.3 million). The measures introduced to increase sales and profitability in the second half of 2022 are taking effect and will continue to be implemented in a systematic manner. These include a close cooperation with key suppliers, the development of alternative solutions to eliminate material shortages, the enforcement of price increases, and the improvement of the margin quality of the order backlog.

The order intake of CHF 226.4 million in the third quarter of 2022 reflects the expected normalization of demand for new equipment compared to the record year of 2021, which was characterized by catch-up effects and the regional shift in demand. In addition, the well-known uncertainties and risks and the continuing extremely long delivery times at key manufacturers had a dampening effect on demand. Due to the slowdown in capacity utilization in the spinning mills, demand for consumables, wear & tear and spare parts also declined in the third quarter of 2022. Major orders continued to be recorded from Turkey, Uzbekistan, and China.

Rieter has a high order backlog of around CHF 2 000 million as of September 30, 2022 (September 30, 2021: CHF 1 562 million), which will guarantee capacity utilization in all three business groups until well into 2023 or rather 2024. The cancellation rate in the reporting period was around 5% of the order backlog.

Outlook 2022

Rieter anticipates weakened demand for new systems in the coming months. The demand for consumables, wear & tear and spare parts will depend on the capacity utilization of spinning mills in the months ahead.

For the full year 2022, Rieter expects sales of around CHF 1 400 million. The realization of sales revenue from the order backlog continues to be associated with risks in relation to the well-known uncertainties.

Despite significantly higher sales compared to the prior-year period, Rieter expects EBIT and net result for 2022 to be below the previous year’s level. This is due to the considerable increases in the cost of materials and logistics, additional costs for compensation of material shortages as well as expenses in connection with the acquisition in the years 2021/2022.

Rieter Management AG