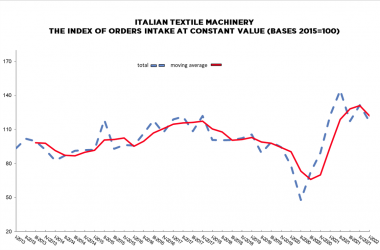

Italian Textile Machinery (ACIMIT): Drop in orders for first quarter 2022

The orders index for textile machinery for the first quarter of 2022, processed by ACIMIT, the Association of Italian Textile Machinery Manufacturers, shows a slight decrease (-4%) compared to the same period from January to March 2021. In absolute value, the index stood at 117 points (basis: 2015 = 100).

On the domestic front orders shrank by fully 22%, whereas abroad the decline was more contained (-2%). The absolute value of the index in Italy was set at 136 points. On foreign markets, the index scored a value of 114.9 points.

ACIMIT President Alessandro Zucchi commented that: “The global pandemic and Russian-Ukrainian conflict have accentuated the climate of uncertainty for the whole of the textile industry. Criticalities already present in the past year (such as a sharp rise in prices of raw materials and their scarce availability, as well as increased transport costs) are now accentuated more than ever. While orders appear to have settled on foreign markets, domestically, following a strong recovery in 2021, we now have to deal with a general negativity permeating the Italian economy.”

The ongoing conflict in Ukraine, together with successive pandemic lockdowns in the main market for textile machinery manufacturers, namely China, have undermined the confidence of Italian companies in the sector. “I believe 2022 will be a transition year for the industry, as we await a calming international economic scenario. In the meantime,” adds Zucchi, “our association continues to work to strengthen the positioning of Italy’s textile machinery industry worldwide through promotional initiatives in collaboration with Ministry of Foreign Affairs and International Cooperation and Italian Trade Agency.”

The latest of these initiatives was carried out at the end of April, with the opening of an Italian technology training center for textile machinery in Mongolia, a Country that ranks among the world’s leading producers of raw cashmere. ACIMIT’s president concludes that, “With the training center starting its operations, our sector is laying the foundations for further business opportunities in an emerging market. I’m certain the initiative will bear a return in terms of image not only for individual Italian companies who are participating by supplying machinery, but on the entire Italian textile machinery sector as a whole.”

ACIMIT