Mimaki Expands Portfolio with Large-Scale 3D Printer

New Mimaki 3DGD-1800 3D printer boasts ground-breaking production speeds and transforms production of large-sized objects, opening up a wide range of new possible applications across industries from sign and display to manufacturing.

Mimaki Europe, a leading manufacturer of inkjet printers and cutting systems, today announces the launch of the new Mimaki 3DGD-1800 3D printer, facilitating large-scale production up to three times faster than with conventional Fused Filament Fabrication (FFF) type 3D printers. The Mimaki 3DGD-1800 3D printer connects the company’s 2D printing expertise and 3D technology innovations, providing customers with a cost-effective, total solution for 3D sign and display applications.

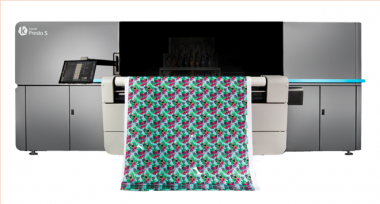

Capable of producing objects up to 1.8 metres tall in just seven hours – with its assembly-based design allowing for the creation of even larger designs – the innovative 3D printing system boasts a number of clever time- and cost-saving features, including dual-head configuration to enable the simultaneous output of two structures. The Mimaki 3DGD-1800 also facilitates the production of support-free hollowed structures, further streamlining production whilst allowing for increased portability and the possible addition of interior illuminations. The technology will open up a diverse range of potential applications, from signage, events and creative art through to interior design. Customers can utilise Mimaki’s extensive portfolio of 2D print solutions to cost-effectively decorate these applications, opening doors to a range of new products that combine creativity and innovation with Mimaki’s tried and tested vibrant, high-quality results.

Commercially available from April 1, 2020, the new Mimaki 3DGD-1800 is set to revolutionise the way in which large-sized objects are created, enabling a switch from costly and time-consuming conventional handcrafting methods which require significant expertise, to effortless, high-speed production utilising 3D data.

Mimaki

Mimaki