Digital Textile Printing: Direct-to-Film Technology

In the printing industry, direct-to-film technology is having a transformative impact on the apparel decoration space. It provides a simple and affordable garment printing process that facilitates vibrant, dynamic, full-colour designs with a durable print. It opens up opportunities for digital print service providers (PSPs) to expand their product offerings in the textile industry, their network of potential customers and expand the range of fabrics they can print on.

Direct-to-film vs. Screen Printing

Direct-to-film printing is the process of digitally printing directly onto a special transfer film sheet. The printed film is subsequently sprinkled with a hot-melt powder and heated. Once the transfer sheet is cured and dried, it can be heat-pressed onto a variety of fabrics to create premium transferred designs for customised merchandising, sportswear, and an array of other promotional applications for the textile market. Compared with traditional screen printing, the plate creation required for that process is far too time-consuming. Not only this, but it does not match direct-to-film’s ability to produce vivid colours and quality details such as shapes, lettering, and motifs often sought after in the promotional and merchandising space for bespoke textiles.

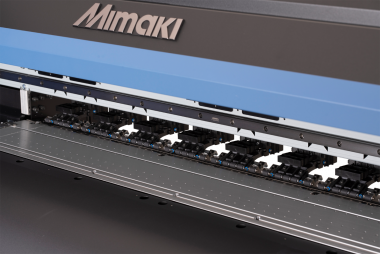

The Mimaki TxF150-75

Mimaki’s first direct-to-film inkjet printer is the TxF150-75, a fitting extension to the 150 series, with a maximum printing width of 80cm. Offering a stable printing plotter, the model’s built-in ink circulation system and degassed ink pack are resolutions to common direct-to-film challenges such as poor ink ejection and white ink clogging. The new printer also includes core Mimaki features including NCU (Nozzle Check Unit) and NRS (Nozzle Recovery System) for stable, uninterrupted print production. Operating in harmony with the textile printer itself is Mimaki’s ECO PASSPORT by OEKO-TEX® certified water-based pigment textile inks, formulated especially for the TxF150-75. Coupled with Mimaki’s RasterLink7 RIP software, users are offered end-to-end oversight and efficiency from creative design to final product.

In addition, and in line with Mimaki’s collaborative approach to meeting customer needs, Adkins has developed an 80cm wide powder shaker cure unit to complete this ‘A brand’ direct-to-film printing solution. By offering the printer and post-processing unit at 80cm wide, customers can print larger garments with less waste and quicker production times, making the process much more cost effective.

Mimaki Europe B.V.