DITF: CO2-negative construction with new composite material

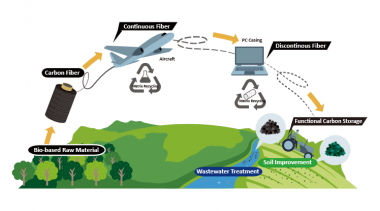

The DITF is leading the joint project "DACCUS-Pre*". The basic idea of the project is to develop a new building material that stores carbon in the long term and removes more CO2 from the atmosphere than is emitted during its production.

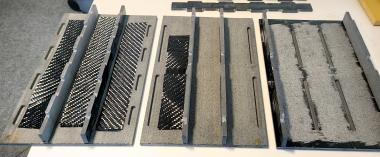

In collaboration with the company TechnoCarbon Technologies, the project is now well advanced - a first demonstrator in the form of a house wall element has been realized. It consists of three materials: Natural stone, carbon fibers and biochar. Each component contributes in a different way to the negative CO2 balance of the material:

Two slabs of natural stone form the exposed walls of the wall element. The mechanical processing of the material, i.e. sawing in stone cutting machines, produces significant quantities of stone dust. This is very reactive due to its large specific surface area. Silicate weathering of the rock dust permanently binds a large amount of CO2 from the atmosphere.

Carbon fibers in the form of technical fabrics reinforce the side walls of the wall elements. They absorb tensile forces and are intended to stabilize the building material in the same way as reinforcing steel in concrete. The carbon fibers used are bio-based, produced from biomass. Lignin-based carbon fibers, which have long been technically optimized at DITF Denkendorf, are particularly suitable for this application: They are inexpensive due to low raw material costs and have a high carbon yield. In addition, unlike reinforcing steel, they are not susceptible to oxidation and therefore last much longer. Although carbon fibers are more energy-intensive to produce than steel, as used in reinforced concrete, only a small amount is needed for use in building materials. As a result, the energy and CO2 balance is much better than for reinforced concrete. By using solar heat and biomass to produce the carbon fibers and the weathering of the stone dust, the CO2 balance of the new building material is actually negative, making it possible to construct CO2-negative buildings.

The third component of the new building material is biochar. This is used as a filler between the two rock slabs. The char acts as an effective insulating material. It is also a permanent source of CO2 storage, which plays a significant role in the CO2 balance of the entire wall element.

From a technical point of view, the already realized demonstrator, a wall element for structural engineering, is well developed. The natural stone used is a gabbro from India, which has a high-quality appearance and is suitable for high loads. This has been proven in load tests. Bio-based carbon fibers serve as the top layer of the stone slabs. The biochar from Convoris GmbH is characterized by particularly good thermal insulation values.

The CO2 balance of a house wall made of the new material has been calculated and compared with that of conventional reinforced concrete. This results in a difference in the CO2 balance of 157 CO2 equivalents per square meter of house wall. A significant saving!

* (Methods for removing atmospheric carbon dioxide (Carbon Dioxide Removal) by Direct Air Carbon Capture, Utilization and Sustainable Storage after Use (DACCUS).

Deutsche Institute für Textil- und Faserforschung