Cinte Techtextil China 2023 set for September

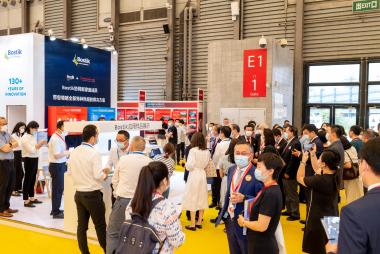

With China easing its pandemic restrictions, foreign exhibitors and buyers can look forward to quarantine-free travel when participating at this year’s industry showcase in Shanghai. The technical textile and nonwovens fair is scheduled to take place from 19 – 21 September 2023 at the Shanghai New International Expo Centre, amid positive market forecasts for both sectors. The organisers are anticipating a strong showing and the conclusion of an inconsistent period for in-person textile business.

“The industry has demonstrated incredible patience and resilience over the course of the pandemic,” said Ms Wilmet Shea, General Manager of Messe Frankfurt (HK) Ltd. “With both markets growing and China opening its borders, we are excited at the prospect of providing participants with an international, business-friendly platform and expect to welcome a healthy number of exhibitors later this year.”

The global technical textile and nonwovens markets are both set to perform strongly over the next few years. According to Grand View Research, the technical textile market is forecast to expand at a CAGR of 4.7% from 2022 to 2030[1]. The nonwoven fabrics market is anticipated to display an even stronger CAGR of 5.6% during the same period[2], with Asia-Pacific to maintain its position as the biggest regional market.

As one of Asia’s leading trade fairs for the abovementioned sectors, Cinte Techtextil China is the preferred platform for multiple industry players. Speaking at the previous edition in 2021, Mr Seven Shen, Sales Manager at Libero Trading (Shanghai) Co Ltd, China, said: “We have been exhibiting at this fair for years, and know we will meet our target customers at every edition. The buyers here are all highly specialised.”

During his interview at the same edition, Mr Eric Ni, Senior Manager, China Supply Chain Marketing for Cotton Council International, USA, commented: “We hope to use this platform to meet more companies and brands in the nonwovens industry who are interested in US cotton, and to meet up with old friends to discuss the current situation and industry trends. The fair’s buyers are quality, and we have found some new potential clients at this edition.”

Many buyers at the previous edition also gave positive appraisals. “As a professional trade fair for technical textile and nonwoven products, Cinte Techtextil China is not only a platform to gather qualified industry players, but also the best place to showcase new products and innovations,” said Mr Lin Bin, Technical Director at Zhejiang Xinna Medical Device Technology Co Ltd, China. “Specific and high quality products enhance sourcing efficiency for buyers, and exposure to new trends and market developments ensures my company visits here regularly.”

The fair’s product categories cover 12 application areas, which comprehensively span a full range of potential uses in modern technical textiles and nonwovens. These categories also cover the entire industry, from upstream technology and raw materials providers to finished fabrics, chemicals and other solutions. This scope of product groups and application areas ensures that the fair is an effective business platform for the entire industry.

[1] “Technical Textile Market Size, Share & Trends Analysis Report 2022-2030”, 2022, Grand View Research, https://bit.ly/3IAxQIK, (Retrieved: January 2023)

[2] “Nonwoven Fabrics Market Size”, 7 September 2022, GlobeNewswire, https://bit.ly/3CxPE3u, (Retrieved: January 2023)

Messe Frankfurt (HK) Ltd