SGL Carbon achieves annual targets for 2023

- Three out of four business units with record sales and results

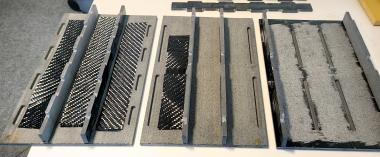

- Carbon Fibers business weighs on the Group's profitability

- Group sales of €1,089.1 million (-4.1%) and adjusted EBITDA of €168.4 million (-2.5%) in a difficult market environment

- Sales and earnings forecast for 2023 achieved despite drop in demand from key market

- 2024 further capacity expansion in graphite components for silicon carbide-based semiconductors

In fiscal year 2023, SGL Carbon achieved the sales and earnings targets set at the beginning of the year despite the drop in demand from the important wind market and an increasingly challenging economic environment. Group sales decreased slightly by €46.8 million (minus 4.1%) to €1,089.1 million (previous year: €1,135.9 million). At € 168.4 million, adjusted EBITDA, a key performance indicator for the Group, was also down slightly (minus 2.5%) compared to the previous year (€172.8 million) but was clearly within the forecast range for 2023 of €160 to 180 million.

While the positive sales development of the Graphite Solutions (+€53.5 million to €565.7 million), Process Technology (+€21.6 million to €127.9 million) and Composite Solutions (+€0.8 million to €153.9 million) business units had a positive effect, the Carbon Fibers business unit had a negative impact on Group sales with a sales decline of €122.3 million to €224.9 million.

Outlook

The global economy will continue to face comparatively high interest rates and subdued growth prospects in 2024. Tighter financing conditions, weak trade growth and a decline in business and consumer confidence are also weighing on the economic outlook. In addition, heightened geopolitical tensions are contributing to increased uncertainty.

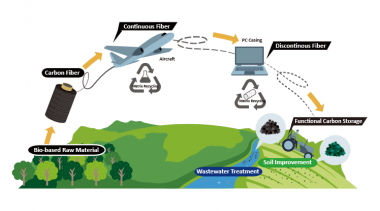

SGL Carbon expects different developments in our key sales markets in 2024. The most important sales and earnings driver will be demand for specialty graphite components for the semiconductor industry. In contrast, all indicators currently suggest that demand for carbon fibers for the wind industry will remain weak in 2024 and that the Carbon Fibers (CF) business unit will therefore continue to record operating losses. Even if demand picks up, SGL Carbon assumes that Carbon Fibers will require additional resources to make the most of market opportunities. With this in mind, teh company announced on February 23, 2024, that they are reviewing all strategic options for Carbon Fibers. These also include a possible partial or complete sale of the business unit.

SGL Carbon's sales forecast for the financial year 2024 takes all four operating business units into account, as the company is only at the beginning of evaluating the strategic options for CF. In line with the assumptions outlined, SGL Carbon is therefore expecting Group sales at the previous year's level (2023: €1,089.1 million).

In the earnings forecast, SGL Carbon has taken into account underutilization of production capacity in the Carbon Fibers business unit and the associated high idle capacity costs. The projected operating loss of CF will have a negative impact on the adjusted EBITDA of the SGL Carbon Group in 2024. Due to the expected positive development of Graphite Solutions, SGL Carbon anticipates an adjusted EBITDA of between €160 million and €170 million for fiscal year 2024, taking into account all four operating business units. Should the process of reviewing all strategic options for the CF business unit result in a sale, the forecast of adjusted EBITDA in 2024 would be between €180 - 190 million.

SGL Carbon SE