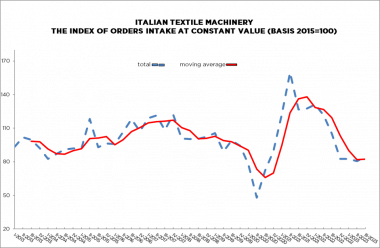

Italian textile machinery: Drop in orders intake in third quarter 2023

The textile machinery orders index, as processed by the Economics Department of ACIMIT, the Association of Italian Textile Machinery Manufacturers, dropped fully 20% during the third quarter of 2023, compared to the same period for July to September 2022. In absolute terms, the index stood at 84.2 points (basis: 2015=100).

This result is due to a reduction in new orders recorded by manufacturers both on the domestic market and abroad. The decrease in orders in Italy came in at 45%, whereas the drop was just 13% on foreign markets. The absolutevalue of the index abroad stood at 80.5 points, and 119.4 points in Italy. During the year’s third quarter, new orders reached 3.7 months of assured production.

ACIMIT President Marco Salvadè commented on the data, stating that, “The order index for the period from July to September 2023 confirms a contraction in collected orders that was already evident in previous quarters. What worries us above all is the situation with our domestic market, where the declining trend has persisted for seven consecutive terms. Due to this situation, which does not only concern the textile machinery industry, urgent measures are needed from Italian Government to strengthen the competitiveness of Italian manufacturers.”

As far as foreign markets are concerned, the orders index confirms an overall weakened global demand for textile machinery. Indeed, for the first half of 2023, Italian exports slowed in a variety of essential benchmark markets, such as Turkey, China and the United States.

“The global economic scenario remains negative, as consumers are facing a reduced purchasing power, with investments in the textile sector consequently also slowing down,” concludes Salvadè. “In less than a month, ITMA ASIA + CITME will be held from 19 to 23 November in Shanghai, primed as one of the world’s major trade fairs for the textile machinery industry, with the participation of roughly 60 Italian textile machinery manufacturers. We can expect some significant indications on the industry’s state from this event, which will be staged in one of the strategic markets for textile machinery demand.”