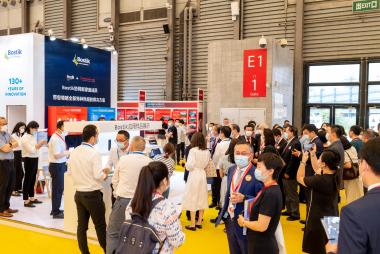

Intertextile Shanghai Home Textiles returns from 28 – 30 March 2023

Intertextile Shanghai Home Textiles – Spring Edition is set for a renewal. After last year’s brief pause, 283 exhibitors from 5 countries and regions will showcase their latest innovations at the National Exhibition and Convention Center (Shanghai) during this traditional peak sourcing period. The fair will be held concurrently with Intertextile Shanghai Apparel Fabrics – Spring Edition, Yarn Expo Spring, CHIC and PH Value from 28 – 30 March 2023.

Comprehensive range of products zoned for easy sourcing

The 27,000 sqm gross exhibition space in hall 5.2 will host suppliers in multiple product categories, such as bedding, towelling, table and kitchen linen, home textile technologies, and textile designs. Several product pavilions and zones will be formed to encourage efficient sourcing, with areas designated for quality bedding, towelling, feather and down duvet fillings, quilt fillings, intelligent equipment and upholstery fabric products. Buyers looking for sustainable fibres, yarns and fabrics may be interested in sourcing at the Lenzing Group’s brand new centralised Lenzing Home Textile Satellite Pavilion. With Lenzing joined by eight of its Chinese downstream manufacturers, the pavilion will showcase the various home textile applications for the Austrian company’s wood-based TENCEL™ fibres.

Other well-known international and domestic exhibitors include Cotton Council International (CCI), Zhangjiagang Coolist Life Technology, Guangdong Kulida Down, Wujiang City Yunjie Textiles, Yantai Pacific Home Fashion, Sunvim Group, and Jiangsu Goostars Hometextiles. These suppliers, and many more, will present their up-to-date products to meet the sourcing demands of buyers from different channels.

Programme

At every edition, Intertextile Shanghai Home Textile’s fringe events keep fairgoers informed on a variety of topics, allowing exhibitors and visitors alike to stay up to date with the latest market trends and make informed business decisions.

Aligning with the fair’s general direction on promoting sustainability, and to satisfy the industry’s needs, representatives from Lenzing will be holding an exclusive seminar about the e-commerce opportunities surrounding eco-friendly TENCEL™ products’ sleep enhancing qualities. Other presentations and discussions that touch on sustainability will also be available under the fair’s Textile & Technology event theme.

With consumers globally paying more attention to health issues and increasing their spending on health products, the home and contract textile industry is also a party to this rising trend. To this end, seminars discussing traditional Chinese medicine and how it relates to different health issues will be held on day one. Their crossover topics include how aromatherapy can encourage high-quality sleep, as well as an introduction on the innovation of traditional medicinal textiles.

Moreover, the well-known Chinese retailer JD.com will co-host an event that promotes home textile products made with Chinese cotton. Several talks will focus on different aspects, such as the products’ quality and the overall potential of this industry aided by government policies.

After China’s relaxation of border restrictions and other pandemic control measures, it is now easier for domestic and overseas buyers to visit their Chinese suppliers at the fairground, for the chance to touch and feel their desired products.

Messe Frankfurt HK, Ltd Intertextile Shanghai Home Textiles Home textiles Intertextile Shanghai Apparel Yarn Expo CHIC Shanghai PH Value

Messe Frankfurt HK Ltd