Indorama Ventures reports a strong 3Q21 performance on record volumes

Indorama Ventures Public Company Limited (IVL) reported a strong 3Q 2021 performance amid record production volumes. The company maintained its positive outlook for the rest of the year and 2022, noting caution as headwinds including higher energy prices and supply chain disruptions weigh against resurgent consumer demand.

IVL reported EBITDA of US$478 million in Q3 versus US$552 million in the previous quarter and US$240 million a year earlier. Production volumes reached 3.73 million metric tons, a record, as the global recovery drove consumer demand for IVL’s products.

As the global economy recovers from the pandemic, consumer appetite and increasing Brent crude oil prices are testing supply chains and driving a commodity boom, with manufacturers running at full capacity. This has driven increases in freight prices and a shortage of materials.

Still, IVL posted a solid YTD performance, ending the first nine months of 2021 with EBITDA of US$ 1,512 million, up 123% YoY. The Integrated Oxides & Derivatives (IOD) segment will start to reap the full benefits of the hot commissioning of the Lake Charles gas cracker (IVOL) in Q4 and beyond, as well as continued advantaged shale gas economics.

In Q3, Project Olympus, the company’s cost saving and business transformation project, achieved US$63 million in efficiency gains, and is on track to achieve a total US$610 million of savings by 2023. IVL also implemented enhanced disclosures in governance, strategy, risk management, and metrics and targets, and launched a comprehensive financial policy and governance structure to accelerate environmentally driven projects.

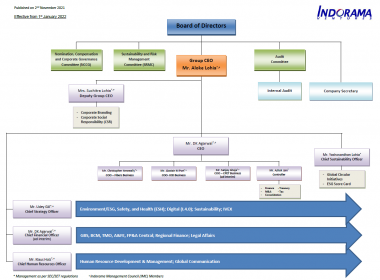

IVL strengthened its Indorama Management Council (IMC) – the company’s highest operational management committee – by rotating experienced executives and adding the COOs of the Fibers and Integrated Oxides & Derivatives (IOD) segments. The appointments will help build the segments into self-sustaining organizations while also rotating expertise across the IMC.

3Q 2021 Performance Summary

- Consolidated Revenue of US$ 3,867M, an increase of 9% QoQ and 50% YoY

- EBITDA of US$ 478M in Q3 versus US$552 million, a decrease of 13% QoQ and an increase of 99% YoY

- Reported annualized EPS of THB 4.53 and core annualized EPS of THB 4.09

Indorama Ventures Public Company Limited