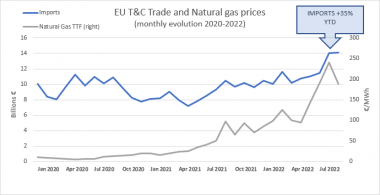

EURATEX addressing EU Energy Council: Cap at 180 €/MWh still too high

On Monday, December 19 2022, the European energy ministers reached an agreement on a price cap for natural gas wholesale prices.

Despite welcoming the adoption of the instrument and the prospect to limit gas price speculations on the stock market, EURATEX considers the cap at 180 €/MWh to be still too high. Also, the complexity of the conditionalities triggering the cap may weaken its effectiveness and implementation: according to the legal proposal, the price level must be reached for three working days and European wholesale gas prices must remain, for the same length of time, at €35 above the global price of liquefied natural gas. Therefore, EURATEX urges the Council of the EU to improve this market correction mechanism.

Furthermore, EURATEX insists on the need to provide the industry with support measures to counteract competition from the US and other countries. Dirk Vantyghem, Director General of EURATEX, affirms: “The Industry is at the heart of the European way of life and the fundament of our social market economy. The European textile industry is 99.8% composed of SMEs, which struggle with tight margins while being at the upstream part of the supply chain: the EU must do more to save its industrial structure, its competitiveness and its capacity to provide essential products to European citizens”.

Euratex