Mahlo at IndoIntertex in Jakarta

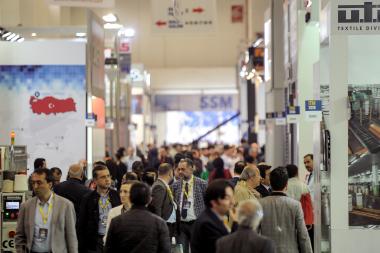

Mahlo GmbH + Co. KG exhibits its technologies at the upcoming IndoIntertex trade show in Jakarta. The event, scheduled from March 20 to March 23, will serve as a platform for Mahlo and its long-term partner agency Agansa to showcase its solutions tailored to meet the evolving needs of the Indonesian textile sector.

With a rich history in textile manufacturing and a skilled workforce, Indonesia has emerged as a key player in the global textile landscape. The country's strategic location, coupled with favorable government policies, has fueled the growth of its textile sector, attracting investments and fostering technological advancements.

Mahlo's participation in the IndoIntertex trade show underscores its commitment to supporting the Indonesian textile industry with solutions designed to enhance quality, efficiency, and productivity. Visitors to Mahlo's booth can expect to explore a range of offerings, including measurement and control systems, process automation solutions, and expert consultancy services.

Mahlo GmbH + Co. KG