Political Tailwind for Alternative Carbon Sources

- More than 30 leading pioneers of the chemical and material sector welcome the latest political papers from Brussels, Berlin and Düsseldorf

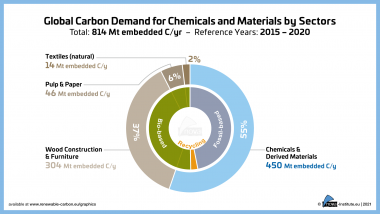

The political situation for renewable carbon from biomass, CO2 and recycling for the defossilisation of the chemical and materials industry has begun to shift fundamentally in Europe. For the first time, important policy papers from Brussels and Germany take into consideration that the term decarbonisation alone is not sufficient, and that there are important industrial sectors with a permanent and even growing carbon demand. Finally, the need for a sustainable coverage of this carbon demand and the realisation of sustainable carbon cycles have been identified on the political stage. They are elemental to the realisation of a sustainable chemical and derived materials industry.

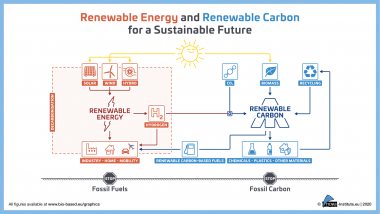

The goal is to create sustainable carbon cycles. This requires comprehensive carbon management of renewable sources, which includes carbon from biomass, carbon from Carbon Capture and Utilisation (CCU) – the industrial use of CO2 as an integral part – as well as mechanical and chemical recycling. And only the use of all alternative carbon streams enables a true decoupling of the chemical and materials sector from additional fossil carbon from the ground. Only in this way can the chemical industry stay the backbone of modern society and transform into a sustainable sector that enables the achievement of global climate goals. The Renewable Carbon Initiative’s (RCI) major aim is to support the smart transition from fossil to renewable carbon: utilising carbon from biomass, CO2 and recycling instead of additional fossil carbon from the ground. This is crucial because 72% of the human-made greenhouse gas emissions are directly linked to additional fossil carbon. The RCI supports all renewable carbon sources available, but the political support is fragmented and differs between carbon from biomass, recycling or carbon capture and utilisation (CCU). Especially CCU has so far not been a strategic objective in the Green Deal and Fit-for-55.

This will change fundamentally with the European Commission's communication paper on “Sustainable Carbon Cycles” published on 15 December. The position in the paper represents an essential step forward that shows embedded carbon has reached the political mainstream – supported by recent opinions from members of the European parliament and also, apparently, by the upcoming IPCC assessment report 6. Now, CCU becomes a recognised and credible solution for sustainable carbon cycles and a potentially sustainable option for the chemical and material industries. Also, in the political discussions in Brussels, the term “defossilation” is appearing more and more often, complementing or replacing the term decarbonisation in those areas where carbon is indispensable. MEP Maria da Graça Carvahlo is among a number of politicians in Brussels who perceive CCU as an important future industry, putting it on the political map and creating momentum for CCU. This includes the integration of CCU into the new Carbon Removal Regime and the Emission Trading System (ETS).

As the new policy documents are fully in line with the strategy of the RCI, the more than 30 member companies of the initiative are highly supportive of this new development and are ready to support policy-maker with data and detailed suggestions for active support and the realisation of sustainable carbon cycles and a sound carbon management. The recent political papers of relevance are highlighted in the following.

Brussels: Communication paper on “Sustainable Carbon Cycles”

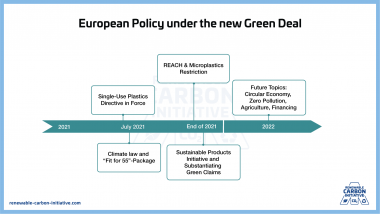

On 15 December, the European Commission has published the communication paper “Sustainable Carbon Cycles” . For the first time, the importance of carbon in different industrial sectors is clearly stated. One of the key statements in the paper is the full recognition of CCU for the first time as a solution for the circular economy, which includes CCU-based fuels as well. The communication paper distinguishes between bio-based CO2, fossil CO2 and CO2 from direct air capture when addressing carbon removal and it also announces detailed monitoring of the different CO2 streams. Not only CCU, but also carbon from the bioeconomy is registered as an important pillar for the future. Here, the term carbon farming has been newly introduced, which refers to improved land management practices that result in an increase of carbon sequestration in living biomass, dead organic matter or soils by enhancing carbon capture or reducing the release of carbon. Even though the list of nature-based carbon storage technologies is non-exhaustive in our view, we strongly support the paper’s idea to deem sustainable land and forest management as a basis for the bioeconomy more important than solely considering land use as a carbon sink. Surprisingly, chemical recycling, which is also an alternative carbon source that substitutes additional fossil carbon from the ground (i.e. carbon from crude oil, natural gas or from coal), is completely absent from the communication paper.

Berlin: Coalition paper of the new German Government: “Dare more progress – alliance for freedom, justice and sustainability”

The whole of Europe is waiting to see how the new German government of Social Democrats, Greens and Liberals will shape the German climate policy. The new reform agenda focuses in particular on solar and wind energy as well as especially hydrogen. Solar energy is to be expanded to 200 GW by 2030 and two percent of the country's land is to be designated for onshore wind energy. A hydrogen grid infrastructure is to be created for green hydrogen, which will form the backbone of the energy system of the future – and is also needed for e-fuels and sustainable chemical industry, a clear commitment to CCU. There is a further focus on the topic of circular economy and recycling. A higher recycling quota and a product-specific minimum quota for the use of recyclates and secondary raw materials should be established at European level. In the coalition paper, there is also a clear commitment to chemical recycling to be found. A significant change for the industry is planned to occur in regards to the so-called “plastic tax” of 80 cents per kilogram of non-recycled plastic packaging. This tax has been implemented by the EU, but most countries are not passing on this tax to the manufacturers and distributors, or only to a limited extent. The new German government now plans to fully transfer this tax over to the industry.

Düsseldorf: Carbon can protect the climate – Carbon Management Strategy North Rhine-Westphalia (NRW)

Lastly, the RCI highly welcomes North Rhine-Westphalia (NRW, Germany) as the first region worldwide to adopt a comprehensive carbon management strategy, a foundation for the transformation from using additional fossil carbon from the ground to the utilisation of renewable carbon from biomass, CO2 and recycling. For all three alternative carbon streams, separate detailed strategies are being developed to achieve the defossilisation of the industry. This is all the more remarkable as North Rhine-Westphalia is the federal state with the strongest industry in Germany, in particular the chemical industry. And it is here, of all places, that a first master plan for the conversion of industry from fossil carbon to biomass, CO2 and recycling is implemented. If successful, NRW could become a global leader in sustainable carbon

management and the region could become a blueprint for many industrial regions.

(c) nova-Institut GmbH

(c) nova-Institut GmbH

(c) nova-Institut GmbH

(c) nova-Institut GmbH

(c) Renewable Carbon Initiative

(c) Renewable Carbon Initiative

(c) Renewable Carbon Initiative

(c) Renewable Carbon Initiative

Renewable Carbon Initiative (RCI)