Rieter: Partnership with Shanghai's DIW

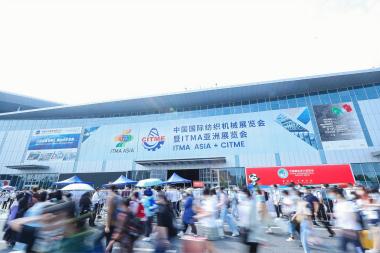

On March 6, 2024, Rieter received an order for the first batch of Rieter technology amounting to around CHF 62 million from Shanghai Digital Intelligence World Industrial Technology Group Co., Ltd. (DIW). Rieter also signed a strategic partnership with DIW to develop an intelligent yarn manufacturing technology that utilizes digitization and automation to minimize conversion costs.

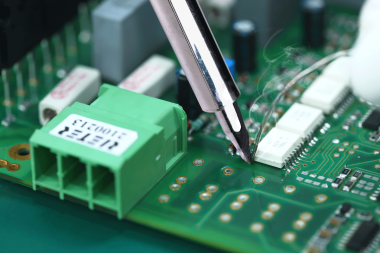

Rieter and DIW signed a first order in the amount of around CHF 62 million for combers and draw frames that will provide the basis to transform DIW’s spinning mills into state-of-the-art industrial textile operations. DIW, a fast-growing company specializing in intelligent manufacturing and industrial operation services, selected Rieter following a competition in which the company’s machines achieved better stability and higher production than competitors. The strategic partnership of DIW and Rieter is designed to further enhance the overall operational efficiency of DIW’s mills by providing highly efficient machines, automation and digitization technology. This will also minimize conversion cost and consolidate the sustainable growth of both companies, while contributing to the high-quality development of the Chinese textile industry.

Rieter Management AG