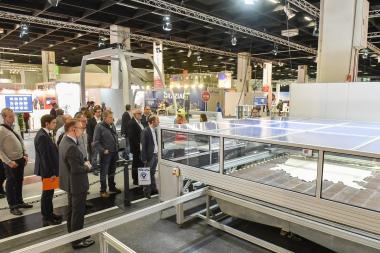

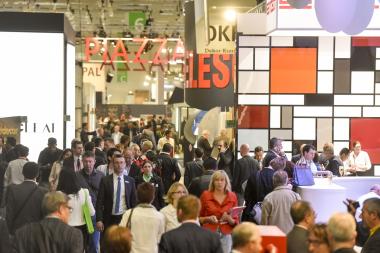

imm cologne "We make it happen"

“We make it happen” is the idea that is currently guiding the whole imm cologne team. As a message to imm cologne exhibitors and visitors, it underscores Koelnmesse’s firm commitment to the industry event and signals that imm cologne will be ready to welcome visitors on 18 January 2021. To increase the event’s reach further, the trade fair organisers in Cologne are working to extend it into the digital sphere with the new imm cologne @home platform.

“We at Koelnmesse believe firmly that everything is possible with our hygiene and safety concept #B-SAFE4business and a positive attitude,” explains Matthias Pollmann, Vice President Trade Fair Management at Koelnmesse. “This progressive attitude is one that many national and international exhibitors and visitors share with us. They are looking forward to networking at the emotional high point of the year for the industry – even if it is clear to everyone that many things will be different next year,” he adds.

Digital formats will ensure maximum reach

The second key challenge facing the team led by Matthias Pollmann and Claire Steinbrück is reaching those visitors who are unable to or do not want to travel to Cologne due to the pandemic. “By extending the trade fair into the digital sphere, we have the best opportunities to increase our reach. Digital reach will be used as a new success criterion for all our trade fairs going forward. It will no longer simply be about the numbers of exhibitors and visitors and where our visitors come from – we want to be measured in terms of our digital reach as well,” says Matthias Pollmann, as he explains the future strategy for imm cologne. “Our goal is to show how many contacts our exhibitors can generate globally in addition to the purely physical visitors,” adds Claire Steinbrück. “gamescom was something like our future lab for reaching consumers, and DMEXCO, which will be hosted this month, will be our blueprint for trade events. Based on our experiences with these two trade fairs, we will draw up a tailored digital strategy for imm cologne by the end of October,” says the trade fair management team, sketching out imm cologne’s evolution into a hybrid format.

Ready for launch: imm cologne @home is in beta

With the launch of the new imm cologne @home platform, the Interior Business Event is doing more than simply expanding business opportunities for its exhibitors. It will also reach a broad spectrum of visitors, creating a diverse range of further possibilities for interaction. The platform will be a forum for virtual exchanges between industry peers, for networking with relevant contacts and elevating business to the next level. In addition to a variety of live-streamed digital stages – including the highly respected talks forum The Stage – there will be open and thematically curated video chats in the virtual cafe, and online trade fair visitors will be able to experience exclusive new launches by imm cologne exhibitors in private showrooms.

Exhibitors to benefit directly from additional contacts and broader reach

Unlike standard webinar and video conferencing systems, imm cologne @home will offer exhibitors more than just the option to stream content – they will also be able to start one-to-one conversations with customers directly. imm cologne @home will thereby offer real networking opportunities, direct dialogues and real-time solutions – a decisive advantage for any exhibitor.

LivingKitchen visitors and exhibitors will also benefit from the new hybrid format. In addition to presenting events and talks programmes digitally, all the functionalities of the new platform will be made available for LivingKitchen as well. Visitors to the Interior Business Event will be able to access imm cologne @home as a website and an app. The platform is designed to serve as an information and communication hub between the industry events and as a digital trade fair for visitors and exhibitors.

Digital content by imm cologne and its exhibitors is crucial to the hybrid trade fair’s success

“By the end of October, we will decide which tools we will take from the large toolbox for DMEXCO and use for imm cologne. What our exhibitors think will play an important role in this. Everything that supports their business is crucial,” says Pollmann. He adds an appeal to the industry: “The path into a hybrid future is one that we cannot and do not want to take alone. In order to reach virtual visitors, it is vitally important that our exhibitors also produce digital content to accompany the content that we can generate as imm cologne. The same rule applies here as it does with a physical trade fair: We provide the platform and activate the visitors. But the products, the innovations, the stories – this is content that has to come from the exhibitors themselves.”

“You make it possible – we make it happen.”

It is crucial for imm cologne that both exhibitors and visitors realise that the trade fair can be a success for their companies, for the entire industry and for Germany and Europe as a hub for commerce and industry only if they themselves adopt the guiding idea behind imm cologne. “You make it possible – we make it happen,” is how Matthias Pollmann puts it in his invitation to the industry to join imm cologne on this journey.

imm cologne

Koelnmesse GmbH