TRADE FORUM FOR HOME TEXTILES COMFORTEX SHOWS "NEW MATERIALITY"

- CADEAUX Leipzig: fabrics capture the room

New cloths the country needs: home textiles revive the modern interior design and are the focus of the professional forum for home textiles COMFORTEX at the CADEAUX Leipzig. From September 3rd - 5th 2016 interior designers, property experts, interior designers and craftsmen learn about the "new materiality" in its whole diversity and receive a comprehensive insight into the color and design trends in fabrics and curtains. In addition, the 49th CADEAUX supplies pulses for attractive decorations and innovative glass art and a variety of inspirations around the current lifestyle and culinary enjoyment.

"In September Leipzig presents the theme living for retailers in a great variety," project director Andreas Zachlod says. "A total of 350 exhibitors and brands show on the CADEAUX and on the integrated expert forum for home textiles COMFORTEX their attractive collections and current editions of a modern lifestyle."

Modern materials for room and window

Prestigious brands dominate the exhibition program in the field of cloth and curtain. Among others, the following companies show their innovations: Brändl Textile, Dr. W. Hufnagl, Edi Michel, Florentina embroidery company, Heinz Weckbrodt, Hossner Heimtex, Jürgen Schleiß Confection, Klippan Yllefabrik, Lutex Fabrication, MB Textilmanufaktur, Otto Dotzauer, Raebel, Rovitex, Stickperle, StiVoTex, Verdi Collection, Vogtländische Home Textiles, Voigtmann & Kruschwitz, W. Reuter & Sohn and Wölfel & Co. and also the EuroCom GmbH with quality pressing irons.

About the most important interior trends in terms of cloth the trend forum "New materiality in the room and at the window" will give detailed information. A café with a lecture area invites to stay in an inspiring lounge atmosphere. Bernhard Zimmermann from the sector agency BZ- BBI (Leipzig) and his creative team provide a comprehensive trend update and draw the essential material milieus in four scenarios. In that the products of all exhibitors of home textiles are positioned in the center. Twice a day professional input about the revived enthusiasm of fabrics and of ideas for modern marketing methods will be given in lectures.

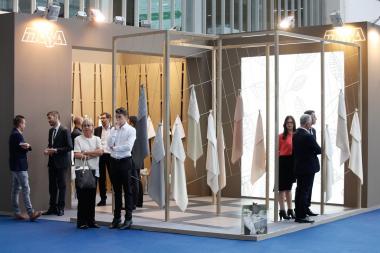

Curtains on a triumphal march

"We want to give the visitors the pleasure of selling home textiles, and illuminate advantages and potentials” Bernhard Zimmermann explains. "The creative power of cloths is just rediscovered." Pioneer was the contract business: Here innovative, easy-care fabrics would be appreciated as an excellent light and sun protection and the aesthetic, acoustic and energetic functions of the textile materials would be used. "But also in the living area we are now on the threshold of a trend reversal. The living styles are changing, curtains and drapes are coming back!"

The new "Generation Cloth"

Through cloth livable, pleasant rooms in the work environment, in healthcare, hotels and in private life would arise, so Zimmermann. "They reflect what the modern human being yearn: a cozy retreat that provides livability a new way and in modern colors and raises family warmth."

Suggestions for today's "Generation Cloth" were provided inter alia by the interpretation of advanced architecture, furniture design and creative textile drape of the 50s and 60s. "The market offers the colorations and patterns for every taste - whether comfortably-natural, progressive-young, factually-geometric or classically elegant," Zimmermann says. Not least products such as pillows, blankets or curtains offer an ideal opportunity for seasonal or mood changes in the room.

Inspirational - the lifestyle trends for fall and winter

Living, furnishing and enjoying: Many inspirations and promotional information about modern lifestyle can be experienced in other exhibition areas. Ralf Meuser demonstrates in the forum "Enjoy Meat" premium kitchen accessories in action. With matching accessories from sharp knives and sharp cutting boards, selected roasters and pans to spice mills the chef prepares high quality meat dishes. With practical tips Meuser gives the retailers important sales arguments at hand and points to the potential which lays in the theme "Enjoy Meat".

A traditional material in a stylish garb is staged in the special show GLASklar with emphasis on enjoyment, home accessories and Christmas. On display are glass products from renowned exhibitors - under the label of "Enjoyment" for example, drinking glasses, carafes, dessert bowls, bottles or étagères. Under the heading "Home Accessories" for example lamps, mirrors, pictures and decoration products will be presented. Christmas tree ornaments and figures determine the theme "Christmas". Furthermore, the forum provides a fascinating insight into the art of glass processing and refinement.

Service: opening times and admission prices

CADEAUX with the special forum for home textiles COMFORTEX is opened on Saturday / Sunday (September 3rd and 4th 2016) from 9:30 AM to 06.00 PM and on Monday (September 5th 2016) from 9:30 AM to 05.00 PM. Trade visitors who register online will receive free admission. At the box office the ticket price is EUR 17.00, for regular visitors EUR 8.00. A legitimation as trade visitor is required. The ticket includes also the admission to the open dowry-area of the parallel occurring watch and jewelry fair MIDORA Leipzig.