ECO PERFORMANCE AWARD and PERFORMANCE AWARD for innovative Summer Fabrics 2023

The digital Performance Days will kick off on May 17 through to May 21, providing online access to even more information, current trends, all the latest material innovations and enhanced tools while providing all within the industry the opportunity to interact with one another and with exhibitors.

The focus of the trend-setting PERFORMANCE FORUM in summer will highlight the winners of the two awards. This year, the jury will present a PERFORMANCE AWARD as well as an ECO PERFORMANCE AWARD.

Function revisited: Outstanding fabric innovations for the Summer 2023 season

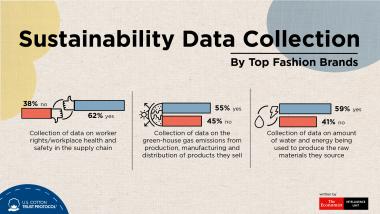

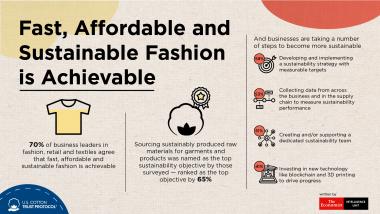

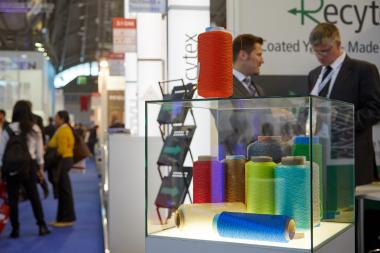

Plant-based fibers such as hemp, organic cotton, bamboo, wool, kapok or coconut shell remain in demand, with manufacturers increasingly refraining from the use of environmentally harmful chemicals, avoiding micro plastics, advocating natural dyeing processes and striving to either return fabrics back into the cycle, to recycle plastic and other waste or to produce fibers in such a way that they are biodegradable.

In the Marketplace, visitors have the opportunity to view more than 9.000 exhibitors’ products, including the fabric highlights of the individual PERFORMANCE FORUM categories. In order to present the fabrics to visitors in digital form as realistically as possible in terms of feel, design and structure, the PERFORMANCE FORUM has been equipped with state-of-the-art 3D technology, including innovative tools such as 3D images, video animations and U3M files for download.

Exceptional: PERFORMANCE AWARD & ECO PERFORMANCE AWARD Winners

For the Spring/Summer 2023 season, the jury also presented two awards for outstanding new developments – so in addition to the PERFORMANCE AWARD, presented to the winner Trenchant Textiles, there is also an ECO PERFORMANCE AWARD winner, in this year’s case, Utenos Trikotazas.

Sustainability at the highest level, wellbeing for body & soul:

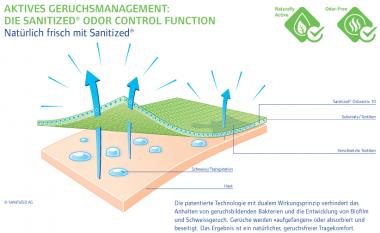

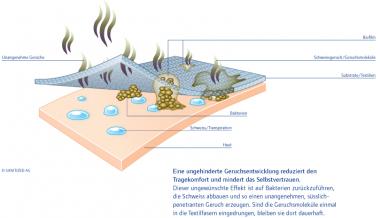

With its fully biodegradable, brushed fleece material made of 11% hemp, 63% organic cotton and 26 % Tencel, Utenos Trikotazas fully convinced the jury and picked up the ECO PERFORMANCE AWARD for its sustainable comfort. The extremely comfy material is pleasant on the skin and impresses with an incredibly soft feel. Hemp is known for its natural anti-bacterial properties and natural UV protection. In combination with organic cotton and Tencel, this fabric guarantees ideal warmth and odour regulation.

Function redesigned, breaking down borders and creating space for the new: In keeping with the Focus Topic of the digital fair week “Still Physical – Your Success Story of 2020”, Trenchant Textiles combined functional features with fashionable design in its new fabric construction, fully deserving of the PERFORMANCE AWARD. The membrane on the outer side, SlickrB, is made of non-toxic, sustainable polypropylene membrane. By printing dot patterns on the surface of the membrane, the fabric provides greater abrasion resistance while maintaining its breathability properties. Absolutely revolutionary: patterns and colors can be altered individually according to preference. The inner liner made of N15DW (15D woven polyamide) also provides tear resistance as well as sufficient, adequate stretch.

PERFORMANCE DAYS / Textination