NEW RECORDS SET AGAIN AT PERFORMANCE DAYS IN MUNICH

The recently concluded trade fair once again demonstrates: The PERFORMANCE DAYS concept works! At the 19th edition of the trade fair for functional fabrics and sport accessories, new top ratings were achieved in all areas.

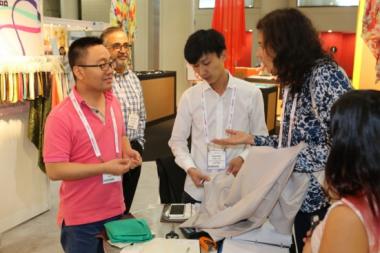

Innovation is the specialty at PERFORMANCE DAYS. The functional fabric trade fair has a reputation for being the first to show the newest trends way ahead of the other trade fairs and industry gatherings. The fair offers several unique tools such as the Focus Topic, the PERFORMANCE FORUM with the PERFORMANCE TABLES and the PERFORMANCE WALL, the PERFORMANCE AWARDS, the comprehensive presentation and workshop program as well as the guided tours. What makes this fair so special? Not only the free admission to the fair, but all of the top quality programs are also free of charge! So much commitment to service and trend scouting pays off: The recent trade fair held on November 8-9th, 2017 at the MTC in Munich once again broke all previous records!

Visitor and Exhibitor plus

The halls of the MTC were filled to maximum capacity and recorded significantly more visitors than the previous fair last April and even more than the fair in November 2016. The number of trade visitors rose from 1868 in November 2016, to 2001 breaking the 2000 mark for the first time. This growth corresponds to a 7.1 percent increase. In comparison to the previous year, the number of exhibitors was also greater in autumn 2017, registering a 9.9 percent increase. A total of 177 exhibitors from 23 countries occupied all of the halls to capacity, confirming the decision to relocate to the halls of Messe München, which is scheduled for November 2018. Even now, shortly after opening the exhibitor registration period, demand is already higher than the number of available spaces.

The move to Riem

When the doors of PERFORMANCE DAYS open next year on November 28-29th, 2018, the trade fair will be celebrating not only its 10-year anniversary, but also the first edition of PERFORMANCE DAYS at the new location. In the future, one of the large halls on the exhibition grounds in Munich-Riem will be provided twice a year for functional fabrics. For the debut, it will be located in Hall C1, with easy access via the north-west entrance from the west parking garage.

All highlights also provided online

As usual, when the most recent exhibit comes to a successful close, a special service is made available to all those who did not have enough time: All the highlights and important information like the presentations (also as a podcast!), as well as all the fabrics at the Forum will be available directly at www.performancedays.com. Even more interesting for you: Samples of all featured PERFORMANCE FORUM fabrics can be ordered online, which means direct sourcing of materials is now possible from the comfort of your office.

A special highlight of the past exhibition was the Focus Topic "Thermal Technologies – From Fibre to Smart Textiles." The topic covered the entire spectrum of heat retention and generation in sports clothing, as well as the ECO PERFORMANCE AWARD. The award winner was Pontetorto for the development of the first fleece to be produced with a brushed inside and with particles and fibers that are biodegradable even in sea-water. This innovation was a joint development between Vaude and Lenzing. The workshop presented by Ana Kristiansson about the possibilities of founding a sportswear brand was also very well received.

Besides the familiar exhibitors like Invista, Cocona/37.5, Lenzing, Microban, 3M, bluesign, Burlington, Dyneema, Nilit, Outlast, Pertex, Polartec, Pontetorto, PrimaLoft, Schoeller, Singtex, Sympatex, Südwollle, Toray, and YKK; the Messe welcomed new exhibitors like Freudenberg Performance Materials, Clo Insulation, Flying Textile, Inuheat Group, ISKO ARQUAS, Manifattura Effe Pi, The Woolmark Company, and Tough Knitting Enterprise.

About PERFORMANCE DAYS

PERFORMANCE DAYS — The “functional fabric fair” launched in 2008, is the first and only event created especially for functional fabrics for sports and work clothing. The aim of the semiannual trade fair is to give leading and innovative textile manufacturers, suppliers and service providers the opportunity to present their functional fabrics, membranes plus treatments, laminates, paddings, fin-ishes, and accessories such as yarns, tapes, prints, buttons and zippers.

The industry experts who come to this fair – the sports fashion designers, product managers, and decision-makers (see online: Visitor List) represent almost every European active clothing and func-tional wear manufacturer – can find a complete selection of high quality materials available at just the right time in April/May and November. The dates are intentionally scheduled early thanks to our expertise in functional fabrics and are optimal for summer and winter sport collections. (All trade fair catalogs from past events are available online at Catalogs as well as a listing of current exhibitors at Exhibitor List).

The relaxed and focused workshop-like atmosphere at PERFORMANCE DAYS differentiates it from the other fairs which are often unmanageable and more stressful. That is one of the reasons why the Munich trade fair at the heart of the European sportswear industry has become one of the top addresses for new fabrics, innovations, and is the preferred meeting place to conduct business.

In the unique PERFORMANCE FORUM of PERFORMANCE DAYS, the visitor receives an inspiring and well-grounded overview of the new materials, trends, and innovations of the exhibitors. The PERFORMANCE AWARD and the ECO PERFORMANCE AWARD are also presented here. Qualified guest speakers present special topics and their collaborative ventures in guided tours, workshops and presentations to complete the range of information provided at PERFORMANCE DAYS within the Program (see after the fair online in the Presentation Library).

No entry fee and free admission to all events for industry visitors.

Performance Days

Textination