Researchers Separate Cotton from Polyester in Blended Fabric

In a new study, North Carolina State University researchers found they could separate blended cotton and polyester fabric using enzymes – nature’s tools for speeding chemical reactions. Ultimately, they hope their findings will lead to a more efficient way to recycle the fabric’s component materials, thereby reducing textile waste. However, they also found the process need more steps if the blended fabric was dyed or treated with chemicals that increase wrinkle resistance.

“We can separate all of the cotton out of a cotton-polyester blend, meaning now we have clean polyester that can be recycled,” said the study’s corresponding author Sonja Salmon, associate professor of textile engineering, chemistry and science at NC State. “In a landfill, the polyester is not going to degrade, and the cotton might take several months or more to break down. Using our method, we can separate the cotton from polyester in less than 48 hours.”

According to the U.S. Environmental Protection Agency, consumers throw approximately 11 million tons of textile waste into U.S. landfills each year. Researchers wanted to develop a method of separating the cotton from the polyester so each component material could be recycled.

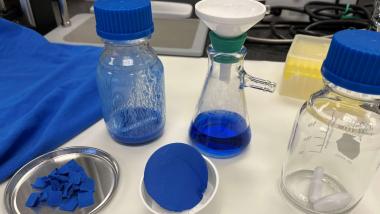

In the study, researchers used a “cocktail” of enzymes in a mildly acidic solution to chop up cellulose in cotton. Cellulose is the material that gives structure to plants’ cell walls. The idea is to chop up the cellulose so it will “fall out” out of the blended woven structure, leaving some tiny cotton fiber fragments remaining, along with glucose. Glucose is the biodegradable byproduct of degraded cellulose. Then, their process involves washing away the glucose and filtering out the cotton fiber fragments, leaving clean polyester.

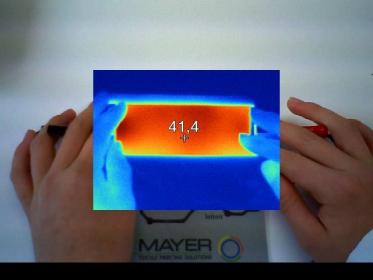

“This is a mild process – the treatment is slightly acidic, like using vinegar,” Salmon said. “We also ran it at 50 degrees Celsius, which is like the temperature of a hot washing machine.

“It’s quite promising that we can separate the polyester to a clean level,” Salmon added. “We still have some more work to do to characterize the polyester’s properties, but we think they will be very good because the conditions are so mild. We’re just adding enzymes that ignore the polyester.”

They compared degradation of 100% cotton fabric to degradation of cotton and polyester blends, and also tested fabric that was dyed with red and blue reactive dyes and treated with durable press chemicals. In order to break down the dyed materials, the researchers had to increase the amount of time and enzymes used. For fabrics treated with durable press chemicals, they had to use a chemical pre-treatment before adding the enzymes.

“The dye that you choose has a big impact on the potential degradation of the fabric,” said the study’s lead author Jeannie Egan, a graduate student at NC State. “Also, we found the biggest obstacle so far is the wrinkle-resistant finish. The chemistry behind that creates a significant block for the enzyme to access the cellulose. Without pre-treating it, we achieved less than 10% degradation, but after, with two enzyme doses, we were able to fully degrade it, which was a really exciting result.”

Researchers said the polyester could be recycled, while the slurry of cotton fragments could be valuable as an additive for paper or useful addition to composite materials. They’re also investigating whether the glucose could be used to make biofuels.

“The slurry is made of residual cotton fragments that resist a very powerful enzymatic degradation,” Salmon said. “It has potential value as a strengthening agent. For the glucose syrup, we’re collaborating on a project to see if we can feed it into an anaerobic digester to make biofuel. We’d be taking waste and turning it into bioenergy, which would be much better than throwing it into a landfill.”

The study, “Enzymatic textile fiber separation for sustainable waste processing,” was published in Resources, Environment and Sustainability. Co-authors included Siyan Wang, Jialong Shen, Oliver Baars and Geoffrey Moxley. Funding was provided by the Environmental Research and Education Foundation, Kaneka Corporation and the Department of Textile Engineering, Chemistry and Science at NC State.

cotton blended fabric polyester enzymatic North Carolina State University Wilson College

North Carolina State University, Laura Oleniacz