Glacier protection rethought: Nonwovens made of cellulosic fibers

Protection for snow and ice: Cellulosic LENZING™ fibers offer solution for preservation of glacier mass

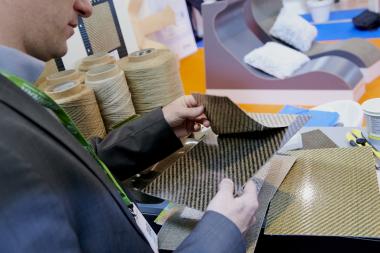

In field trials on Austrian glaciers, nonwovens made of cellulosic LENZING™ fibers are being used to cover glacier mass. They are showing promising results and offer a sustainable solution for glacier protection. Nonwovens containing fossil-based synthetic fibers might cause negative environmental consequences such as microplastics on glaciers.

Geotextiles are already widely used to protect snow and ice on glaciers from melting. The use of nonwovens made from cellulosic LENZING™ fibers is now achieving a sustainable turnaround. Geotextiles show great success in Austria in protecting glaciers, which are highly endangered by global warming. By covering glacier mass, its melting is slowed down and mitigated. So far, the nonwovens used to protect glaciers are usually made of fossil-based synthetic fibers. The problem with that might occur as microplastics left behind after the summer flow down into the valley and can enter the food chain through small organisms and animals.

Sustainability from production to reuse

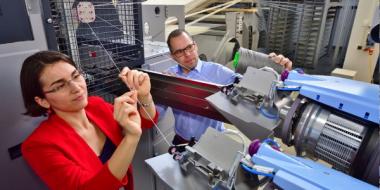

An innovative and sustainable solution for the protection of snow and ice is now possible with the help of nonwovens made of cellulosic LENZING™ fibers. "LENZING™ fibers are derived from renewable, responsibly managed wood sources and are produced in an environmentally responsible process. Thanks to their botanic origin, they have the ability to break down, returning into nature after use" explains Berndt Köll, Business & Innovation Manager at Lenzing.

In a field trial on the Stubai Glacier, the covering of a small area with the new material containing cellulosic LENZING™ fibers was tested for the first time. The result was convincing: 4 meters of ice mass could be saved from melting. Due to its success, the project is now being expanded. In 2023 field tests started in all Austrian glaciers, which are used for tourism.

"We are pleased with the positive results and see the project as a sustainable solution for glacier protection - not only in Austria, but beyond national borders," Berndt Köll continues. There should also be a possibility to explore for recycling after the nonwovens are used: These geotextiles can be recycled and ultimately used to make yarn for textile products.

Awarded with the Swiss BIO TOP

The sustainable glacier protection and its results also convinced the jury of industry experts of the BIO TOP, a major award for wood and material innovations in Switzerland. With this award innovative projects in the field of bio-based woods and materials are promoted and supported. At the award ceremony on September 20, 2023, Geotextiles containing LENZING™ fibers were honored with the award for its solution.

Lenzing AG