„CREATE’N’CONNECT“– KEYNOTE THEME FOR DOMOTEX 2019

- Opportunity for manufacturers to star as trendsetters in the flooring industry

The redesigned DOMOTEX – with its more transparent clustering of allied products and the visually stunning “Framing Trends” showcase – has been warmly embraced by the market and is now gearing up for its second season. DOMOTEX 2019 will run under the banner of “CREATE’N’CONNECT”, a keynote theme that puts the spotlight on innovative flooring industry developments and ideas inspired by today’s connectivity megatrend. Powered by advanced technology and digital change, being connected is a tremendously important aspect of our daily lives and interaction at home and on the job. Connectedness is an important aspect of flooring in the sense that floors are unifying, connecting elements of room design. Floors and flooring provide the very foundation for the rooms in which we live and work. Floors inspire us, give us orientation and set the stage for human interaction.

“CREATE’N’CONNECT” keynote theme to be creatively staged by trend leaders

The “Framing Trends”special area in Hall 9 at DOMOTEX 2019 is a unique opportunity for manufacturers to breathe life into the “CREATE’N’CONNECT” theme and thereby demonstrate their creative genius and position themselves as trendsetters of the flooring industry. Complete with a quality supporting program of talks, lectures and discussions inspired by the keynote theme, “Framing Trends” is a vibrant networking platform and the beating heart of DOMOTEX. It is a place where creatives from all parts of the design spectrum can gather, make connections and contacts and spark new business opportunities. For manufacturers, retailers and designers, it is also a rich source of inspiration for new collections. With its out-of-the-ordinary artistic staging and groundbreaking product presentations, “Framing Trends” is an absolute magnet for fashion and lifestyle-savvy visitors, architects, interior decorators, designers and influencers.

“Framing Trends” - Apply to exhibit and start making connections

As a major highlight of DOMOTEX, the “Framing Trends” special area is one of the main stops on the show’s special Guided Tours for architects and journalists. This premium exposure is further enhanced by the area’s strong presence in the organizer’s social media channels and on the DOMOTEX website. Furthermore, companies that give exclusive interviews at DOMOTEX are permitted to use the interviews for their own promotional purposes. As in 2018, the “Framing Trends” showcase at DOMOTEX 2019 will have a Blogger Lounge where bloggers and visitors can meet up, talk and collaborate.

The “Framing Trends” area includes the “Flooring Spaces” zone – a series of spaces where selected exhibitors and companies from the flooring industry can stage their unique, creative visions of the “CREATE’N’CONNECT” theme in the form of physical installations, interactive display circuits or workshops. Applications for participation at the “Flooring Spaces” zone are now open. Each applying organization is invited to submit a design proposal for a “Flooring Space” of any size from 20 sqm to 60 sqm. On request, the DOMOTEX organizers will arrange for designers to help applicants with their proposals. An expert jury made up of big-name designers and architects will select the participating exhibitors from among the applicants. The jury will make its decision by the fall of 2018.

Examples of creative flooring-related connections

The connectivity theme can be creatively expressed in many wonderful ways, as the following examples from the flooring and various allied industries show.

In teamwork with the studio Lotta Agaton Interiors, Austrian carpet maker Tisca Textil staged a home environment collage at DOMOTEX 2018 combining handmade woolen rugs with furniture by Vitra, Artek and Team7.

The lively graphic motifs used in the Infused Collection by Mannington Mills conjure up various aspects of five different U.S. metropolises. This LVT tile collection’s mix-and-match approach lends itself to the creation of imaginative mosaics using any combination of tiles desired.

Swedish design firm Kinnasand presents its rugs on a limited series of steel tubing “structures” created in cooperation with Berlin design studio Greiling. Draped over stylized bench, ottoman and daybed structures, the carpets take on a three-dimensional aspect.

Furniture manufacturer Walter Knoll uses the floor pillows and daybeds in its “Badawi Pillows” collection to create connections with its own sofa and carpet range. Details like the finishing on the leather headrest rolls attest to the firm’s high level of craftsmanship.

Gan, the rug and textile brand of Spanish outdoor furnishing company Gandia Blasco, includes a whole range of new products that explore the connection between rooms and their floors. For example, the “Parquet” kilim collection by Swedish designer duo Front (Sofia Lagerkvist and Anna Lindgren) reinvents the timeless aesthetic of wood parquet in soft floor coverings. Meanwhile, the “Mirage” collection by Spanish designer Patricia Urquiola comprises hand-knotted rugs made from New Zealand wool that look like they are woven from three dimensional planks whose ends protrude into the surrounding space. Her “Garden Layers” collection features layers of rugs, mats, roll pillows, cushions and even textile-covered Indian beds. The individual elements can be arranged in many different ways to create infinite inviting possibilities for outdoor living.

“Framing Trends” showcase well received by the market

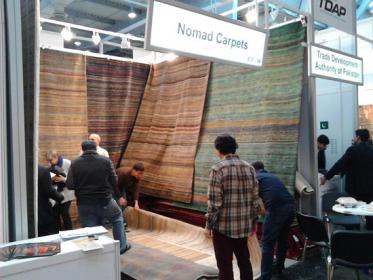

Business decision-makers who participated in the inaugural “Framing Trends” showcase were full of praise for the enhanced DOMOTEX format. Their stories are glowing reports of successful business contacts made at DOMOTEX 2018. For instance, Jutta Werner, CEO of Nomad, an interdisciplinary design firm in Hamburg, described the “Flooring Spaces” area as a “well signposted proving ground for innovation and contemporary thinking.” She said the response to her presentation there was “overwhelming.” Benny Jensen, CEO of Denmark’s Fletco Carpets, was impressed with the Guided Tours and their ability to communicate targeted information to visitors. He said the tours enabled his company to present its new, award-winning “LockTiles” product directly to a quality, pre-qualified audience. Jensen noted that “architects, designers and planners made a special point of visiting the ‘Framing Trends’ display.” Floor coverings manufacturer Classen used the “Flooring Spaces” zone at “Framing Trends” to present a vision of a living space from the future. The flooring creation at the heart of Classen’s “Flooring Space” was developed specially for DOMOTEX at the company’s own design center, while the creative design and production of the space as a whole was undertaken on Classen’s behalf by a designer. The presentation raised Classen’s profile as an innovator. Marketing Director Heinz-Dieter Gras says the visitors showed a “great deal of interest” and described the presentation as “spectacular” and “masterfully done”.

Thomas Trenkamp, CEO of Carpet Concept, was very pleased with the “massive response” to his company’s “Framing Trends” presentation generated in the press and among industry peers and trade visitors. The kaleidoscope project which Carpet Concept realized in partnership with Schmidhuber, Munich, was a major attraction on site, in the press and across social media channels. Creative Matters, a Canadian design firm that specializes in carpets, rugs and wall coverings, staged a series of creative workshops that proved enormously popular with attendees. President and co-founder Carol Sebert described “Framing Trends” as a “vibrant, high-energy” showcase that enabled exhibitors and visitors to “experience the latest innovations and creations in the flooring world first-hand.” Jürgen Dahlmanns, the founder and creative mind behind cutting-edge German carpet label Rug Star, believes that DOMOTEX’s managers have moved the show in an “exciting new direction” with Framing Trends. “It’s a fun thing to be involved in as an exhibitor”. Textile floor coverings specialist Balta Group, of Belgium, has been exhibiting at DOMOTEX right from the early days. Marketing Director Geert Vanden Bossche said the new format has “further cemented the strong connection” his organization felt with DOMOTEX. Balta exhibits both at DOMOTEX in Hannover and at DOMOTEX asia/CHINAFLOOR in Shanghai.

DOMOTEX 2019 will be held in Hannover, Germany, from 11 to 14 January (Friday through Monday). The show is expected to feature around 1,400 exhibitors from more than 60 nations.

Legends of Carpets Badawi Pillows (c) Walter Knoll

Legends of Carpets Badawi Pillows (c) Walter Knoll

Tisca Textil Vitra Artek-Team 7 (c) Deutsche Messe AG

Tisca Textil Vitra Artek-Team 7 (c) Deutsche Messe AG

Garden Layers indian bed (c) Gan

Garden Layers indian bed (c) Gan

Domotex

Deutsche Messe AG