imm cologne 2020: Ready for better living

- The industry kicks off the new year with a dynamic start

imm cologne drew to a close on 19 January 2020, with positive overall results. More than 128,000 visitors (including estimates for the last day of the trade fair) attended the event to find inspiration from the industry. Going against the trend for other industry trade fairs held early in the year, imm cologne achieved an increase in visitors compared to the most recent similar edition of the event (2018: 125,000 visitors).

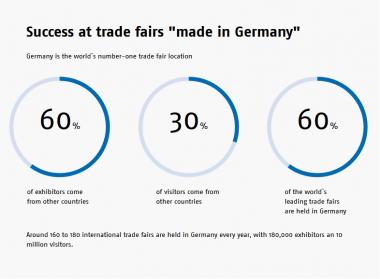

As in previous years, imm cologne also had a very strong international profile. Of the 82,000 trade visitors (2018: 80,704) around 50 per cent came from outside Germany. Despite the concentration visible in the German wholesale and retail trade, the event recorded a small rise in domestic trade visitors, again bucking the trend in recent years. “With these results, imm cologne not only underscores its prominent position in the global business; the increase in planners, architects and contract furnishers from Germany further emphasises its importance for the German market,” said Gerald Böse, President and Chief Executive Officer of Koelnmesse. The Managing Director of the Association of the German Furniture Industry, Jan Kurth, also gave the event a highly positive verdict: “For the exhibitors, imm cologne was a commercially successful trade fair that allowed the industry to make an excellent start to the 2020 furniture year. Cologne has once again demonstrated its significance as a platform for contacts and inspiration but also as an ordering fair. Together with all those involved, we will continue to strengthen the importance of this key event in a transforming market environment.”

The eight most important living trends of imm cologne 2020

How we live is important to us. An ever increasing number of people are considering how they can live and reside more sustainably, where they will live, with whom they will live, how their apartment should look so they can feel at home there and what the furnishings of their homes say about them. The international interiors show imm cologne is a mirror image of current interiors trends and demonstrates the inventiveness of furniture makers.

Interior design is currently becoming increasingly cosy, and the theme of comfort appears to be dominating not only private living space, but also property and hospitality areas. Following the bathroom, the entrance area is now also being discovered as an object of design. The wish for a good interior design appears to become all the more important, the more one wishes to or is forced to limit oneself to a few, high-quality furnishing elements. This is because, conscious limitation toa little is one of the trends characterising contemporary interior design.

Like in fashion, the pendulum seems to be moving from "more and more and cheaper and cheaper" toward a relative orientation to quality. In the process, there seem to be two stylistically and qualitatively differentiating main directions: while the interiors culture characterised by the design scene continues to prefer a reduced, simpler language of form with natural expression and materials, more glamour is called for in more traditional and in fashionable interiors worlds: it should be refined, be originally expressive and possess classic charm.

Yes, living is becoming more important. This is also an increasingly decisive factor for how life is organised, with concepts like co-working and co-living, the patchwork house or urban gardens. More thought is also being given to the things we bond ourselves with, and we tend to look twice before a decision is made in favour of a good piece. An orientation to quality does not necessarily exclude the search for bargains. While one person might research prices, the other researches the previous life of the item of furniture, including the origin of the materials, recycling capability and general harmlessness with regard to nature, climate and social standards. All agree that we want to live better: more comfortably, more stylishly, using space more effectively, more colourfully, smarter and more sustainably.

More natural living

An ever increasing number of people are seriously attempting to change their consumer behaviour in order to initiate a trend turnaround toward a sustainable society. Consumer decisions with regard to mobility, mobile phone or nutrition, just as much as for furniture, are being increasingly evaluated under the aspect of climate neutrality. The story behind the product, the storytelling, is thus becoming more important all the time. This means that natural materials and solid wood are preferred in the home, not only for reasons of cosiness, but also with an eye to ecological considerations. Supporting decorative items, such as plants, untreated fabrics and indoor greenhouses are becoming important furnishing elements for home design and are also conceived of as statements. Furniture of high design quality also holds the promise of sustainability.

Wood and natural materials, but also lightweight design and recycling materials are being used everywhere where they are functional, meaning also for products that are usually manufactured from other materials. Bamboo is being tried out as an alternative to wood, just as much as plastic-reinforced paper as a leather-like upholstery fabric. Wickerwork of rattan, willow or bamboo brings a winter garden feeling into the house. The longing for natural living is keeping the trend toward Scandinavian design alive. It is after all associated with a near-natural, uncomplicated and original, rustic lifestyle, which is expressed in the traditionally simple design cultivated in the 20th century.

Greener living

We increasingly want to be close to nature: no new apartments are being built without balconies; apartments and houses with access to gardens or patios are in high demand, especially in urban areas. These touchpoints with nature are now also becoming an integral part of our homes, with patios taking on the role of a second living room. In the wake of the "Indoor – Outdoor" trend, weatherproof outdoor furniture now not only looks like it comes from the living room, it is also used there! Elegant materials and high-tech textiles also make it possible for them to be used indoors. An aesthetic difference is hardly recognisable in the upper price segment and, in the case of the new indoor/outdoor furniture, the comfort of use is also increasingly comparable. In the case of outdoor colours, the colour grey seems to have passed its zenith. White positioned itself as the base colour for outdoor furniture at the spoga-gafa trade fair in Cologne.

The furniture that suits this trend in some cases resembles that from the trend of more natural living: bamboo and wickerwork furniture is popular, but wicker armchairs of high-tech materials and more fashionable accents are also opportune. Plants are found as accessories not only in pots, but also on wallpaper. Green can be found in all shades.

Smarter Living

Can we use an app to grow herbs? Can computers nurture plants to improve air quality? Does the climate have an impact on building services? Does a smart control system switch off the lights and the coffee machine when you leave the house? Smart applications are becoming ever more diverse, reliable and easy to use and can be tailored increasingly precisely to the specific needs of residents. As a result, smart technologies are increasingly playing a key role in architecture. Whether computer-controlled optimisation of indoor air quality, the innovative control and operation of shower toilets or the anticipatory and energy-optimised regulating of room temperature, smart technology is being increasingly integrated into the way we live.

Lamps that serve as Bluetooth loudspeakers; night tables with cordless mobile phone charging stations; cabinets that provide mood lighting; mirror cabinets with multimedia function, tables that adjust to our ideal amount of movement and sofas that note the individual favourite seating position; lights that help us fall asleep and beds that nudge us gently into another position when we snore. Technology is becoming an integral, ideally inconspicuous element of furniture.

More efficient living

Rising rents and smaller homes will continue to drive the demand for space-saving furniture. The first wave of the trend toward tidiness and renunciation aesthetics has already reached us from the USA and Asia. Renouncing consumption and restricting ourselves to the essential things in life are strategies for creating order in the home. And more and more people are finding this approach extremely beneficial. Order is trendy, so anything else is once again “uncool”. Quality over quantity could therefore be the perfect home furnishing philosophy for many people, especially as it is also consistent with the desire for natural living.

A trend for some time now has been small and compact sofas and armchairs with a design often oriented to classic typologies. Even more sought after in future will be affordable system furniture and compact individual items, which are scalable (adaptable to different room dimensions), variable (pull-out technology, etc.) and versatile. Life on a second level is also becoming trendy; the high sleeper is making a comeback. In view of the wide range of applications for such furniture systems, from the mini-apartment to the loft, suppliers are, however, attaching great importance to modern aesthetics in an urban living style that goes far beyond any teenager’s bedroom atmosphere.

Living more comfortably

We are worth it! Comfort is written in capital letters in every home (no matter how small), especially in the bedroom. However, investments are also being made in the bathroom and seating furniture. Comfort also involves several standards of building services; keywords here include the heated car seat, heated or cooled rooms. Compact, design-oriented seating, such as two-seater sofas or armchairs, is the trend in the upper product segment. Here, special attention is paid to ergonomics. Console table, wall rest tables or small shelves not only assure a sense of order in everyday life, but are instead an integral element of interior design.

And the favourite place for a comfortable hammock is found not only in the garden. It began with stools, and now bench seats, with and without backrests, have also been given soft upholstery to add a comfortable highlight to the kitchen and dining area. For sofas, the trend is toward a platform raised off the floor, which lifts the cushions to a higher level, as well as toward individualisation and adjustability. Integrated occasional tables are a theme.

Living without limits

The requirements of living are currently changing quite rapidly. More sophisticated singles apartments with a scarce offering of space and a lifestyle that also seeks freedom from conventions when it comes to furnishings are reinforcing the trend toward generously dimensioned one-room apartments with a loft feeling. These are complemented by one or two work rooms or bedrooms as needed. The flowing into one another of the rooms leads to a need for multifunctional furniture that marks living areas or delimits them from one another. Kitchen and living merge, the bathroom remains separate, if also, at least in the high price range, "en suite" and a little bit bigger. Instead of separate rooms, modern apartments present an open spatial structure, and compartmentalised apartments in old buildings are "aired out" through the removal of wall elements. Winter gardens and converted attics open up bright spaces, and generously dimensioned window fronts, ideally opening without thresholds, also optically expand the space outwards.

With the exception of built-in cabinets, single items of furniture are called for. Consistent collections and walls of cabinets in the living room encumber the feeling of freedom too much; mix & match is better suited. However, the single items of furniture must be combinable to this purpose. Finding the right balance in the design, autonomous, but not extroverted, pleasing but not boring, is the art of this furniture with classic qualities. Multifunctional furniture like tables that function convincingly as a workplace and dining area, freestanding sofas, cabinets that function as storage space and wall elements, room partitions that enable functions on both sides (like integrating the pivoting monitor that can be used from both sides), mobile furniture for indoors and outdoors; these are the heroes of living without limits.

Colourful living

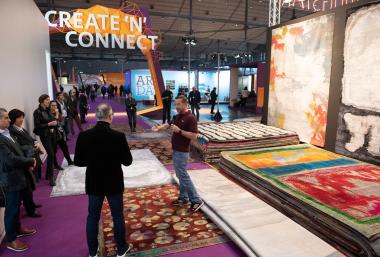

Among the colour trends in interior design, brown is surely the one with the strongest impact, because it can be used both neutrally and in an avant garde fashion. On the whole, shades of brown are responsible for cosiness and are therefore currently very popular. While things are very harmonious in the range from greige through taupe to moor oak, the combination of, for example, nougat brown with other, mostly reserved colours (meaning not used in neon or pastel) ranging from orange to turquoise is also quite bold. However, whether with green, pink, purple or brown, colour brings glamour into the apartment. Dark wood shades, reminiscent of Art Deco or Danish modernity, with gold, brass or other metallic accents on sumptuous rugs stand for pure luxury. While the overall interior design trend is toward dark colours, from dark greens and blues to black, the minimalist interiors style remains loyal to the lighter and more natural shades. Avant-gardists pledge themselves to the Bauhaus tradition with primary colours colourfully combined with a white base colour. However, the interiors scene as a whole is becoming more colourful through the intensive use of colour schemes. Monochromaticity is also being increasingly abandoned in favour of patterns.

Decorative living

After clothing, living is today the number one means of expression. We are not only what we wear, but how we live. This makes every decorative element a statement. The basis for any eyecatcher is a space to make an impact. Tidy optics and decorative elements thus don't need to contradict one another. Lifestyle and the decorative are staged, on the wall elements, in the textiles, on the floor … or also behind (illuminated) glass. Each element and each item of furniture is simultaneously a decorative element. Which is why single products are preferred over homogeneous interior design with the furniture of a collection. Lights adjust to any furnishing style and are increasingly used as an optical highlight of the space. Designer lights are now what the folding table on rollers was in the 1970s.

Both mirrors and pictures are readily used as design elements: the classic here is the circular mirror in all versions; here the mirrors are often used graphically (thus pronouncedly two dimensionally) and bring depth to the room. As cement or Metro tiles, tiles transform from tepid floor coverings to the cool highlight at the kitchen bar, in special sections of the wall or in the entrance area. On the walls, it is wallpaper with small and large-format patterns that turn a room into a veritable work of art. On the floor, rugs with geometrical patterns, floral elements or graphic fancies provide accents, here too as a single product again. Oval shapes are especially pronounced, and, among furniture items, the sideboard is by far the most decorative: not only as a presentation surface, but also as a type.

Koelnmesse GmbH