DOMOTEX 2019 - A TRADE FAIR TO CONNECT THE CONTINENTS

- Final Release

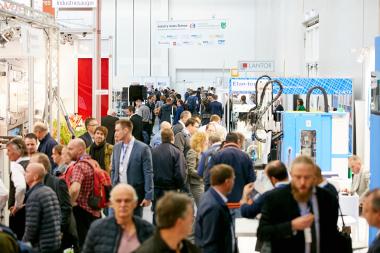

The latest edition of DOMOTEX – the world’s leading showcase for carpets and floor coverings (January 11 to 14) – has underscored its reputation as the sector’s biggest and most important hub for business, innovations and trends. Over 1,400 exhibitors from more than 60 nations came to Hannover to kick off a successful new year of business. With close to 90 percent of all attendees having decision-making authority, the caliber of the show’s visitors remained extremely high – a fact confirmed by exhibitors. Due to growing market concentration, DOMOTEX recorded a slight dip in attendance. According to the exhibition survey, the order situation of exhibitors remained constant, while the purchasing volume per visitor went up. About 70 percent of all DOMOTEX attendees once again came from abroad – a clear sign of the flagship fair’s international appeal. In terms of visitor backgrounds, attendance was notably up on the part of wholesale and retail professionals. The figures also revealed an increase in attendance by architects, interior designers and contract business professionals. In addition, DOMOTEX 2019 saw an increase in the amount of display space sold.

“Thanks to its strong international drawing power, DOMOTEX serves as the sector’s definitive global marketplace. The positive and optimistic outlook on the 2019 business year that was tangible in the trade fair halls proves the success of this year’s exhibition,” said Dr. Andreas Gruchow, the Managing Board member in charge of DOMOTEX at Deutsche Messe.

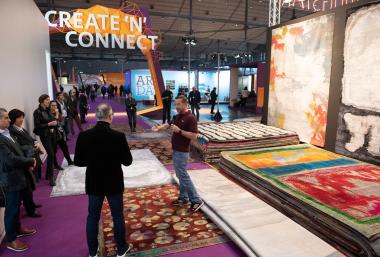

“Manufacturers and customers as well as partners, architects and designers from all over the world come together to network at DOMOTEX, spawning new business relationships and collaborative opportunities previously not deemed possible,” remarked Sonia Wedell-Castellano, the new global director for DOMOTEX, adding: “That’s what this year’s theme of Create’N’Connect is all about.”

Upbeat mood among exhibitors

Fabian Kölliker, Head of Marketing at the Swiss Krono Group, voiced early praise for the professional nature of the event: “We are very satisfied with the number, quality and internationality of attendees. Even after day two of the fair, we are already extremely happy with our success so far.”

The Balta Group has remained faithful to DOMOTEX since the origin of the fair. As Marketing Director Geert Vanden Bossche reports: “The rug business is a global business and this is the best place to connect with people and customers from around the world. In only four days we can meet with a lot of customers, giving a good return on our investments.”

For Myriam Ragolle, Managing Director of Ragolle Rugs, DOMOTEX represents the ideal opportunity to present the new products to a worldwide audience within just a four-day period: “It is impossible to achieve that by traveling. We can also make contacts with new customers from all over the world. This makes DOMOTEX unique.”

Exhibitors from the skilled trades also expressed keen satisfaction with the run of the show: “Here at DOMOTEX 2019, we have once again succeeded in impressing a trade audience from Germany and abroad,” said Julian Utz, CEO of Uzin Utz, adding: “The show’s international focus gives us access to exactly the right potential customers.” As he pointed out, Uzin Utz is strongly focused on Asian and Arab-speaking markets. “So the strong turnout by customers from these regions is a real boon for us.”

The benefits of attending DOMOTEX

Susanne Gerken, a Color & Trim designer at Volkswagen, came to DOMOTEX 2019 to catch the latest trends and check out innovative materials. As she pointed out, color trends and issues such as sustainability, recycling and new material lifecycles are all equally applicable to the automotive industry, and her takeaway was much more than just new impressions: “At DOMOTEX I picked up several ideas I can use to great advantage in my work.”

In contrast, business matters were the prime objective for Alex Hosseinnia, CEO of Dallas Rugs in Dallas, Colorado: “My line of work is all about buying and selling,” he said, adding that what he liked about DOMOTEX was the way it made it easy for him to meet up with suppliers, and that it was an ideal place to discover the latest trends and fashions, for example colors and patterns, that were “likely to be showing up in U.S. retail channels in the course of the next year or two.”

“CREATE’N’CONNECT” at DOMOTEX 2019

The inspiring “Framing Trends” showcase in Hall 9 proved its worth. In its second year, it once again featured impressive displays of innovative products by manufacturers, artists, designers and students. International architects, designers, planners and influencers were particularly appreciative of “Framing Trends” as the beating heart of the event. The new showcase has proven to be highly effective at bringing visitors together and spawning lively interaction and business dialogue.

Under the motto of “Gaining Ground”, the “Treffpunkt Handwerk” skilled trades hub in Hall 13 proved popular among interior designers, parquet and floor layers, painters and varnishers. The hands-on demo area gave flooring experts an opportunity to see innovative floor treatment and finishing tools and machinery in action while comparing notes with fellow professionals.

Digital tools for sales and marketing in the floor covering industry

A key topic at the event involved solutions for the digital presentation of carpets and floor coverings. The new digital solutions ran the gamut of VR and AR applications, including visualization aids for every aspect of the marketing mix, plus innovative software which makes it easy for customers to discover and choose their favorite designs and collections while providing retailers with new options for digital product presentation and sales.