World Natural Fibre Update - January 2023

Price Trends

- The nearby cotton futures contract on the Intercontinental Exchange was down just 1% in December and closed the year at $1.84 per kilogram. A year earlier, the March contract closed at $2.30 per kilogram.

Cotton futures have been inverted for nearly three years because of supply chain disruptions that prevented normal on-time deliveries of international shipments. With the easing of container shortages and increased sailings, cotton futures are gradually reverting to the normal pattern in which contracts for forward delivery exceed nearby contracts by the cost of insurance, storage and interest between delivery months. The May and July 2023 contracts also finished 2022 at $1.84 per kilogram. In November, the May and July contracts were each several cents per kilogram lower than the March contract. - The Eastern Market Indicator of prices for fine wool in Australia rose 9% in December to US$9.06 per kilogram. A year earlier, the EMI was $9.66. Australian analysts note that sheep for meat, cattle, and grain production, are competing alternatives for the use of land, and wool prices must continue upward if production is to be maintained in 2023.

- Prices quoted by the Indian Jute Balers Association (JBA) at the end of December converted to US$ fell 2% from a month earlier to an average of 74 cents per kilogram. The decline occurred entirely because of a weakening exchange rate. Prices in Rupee rose marginally. A year earlier, quoted prices averaged 84 cents per kilogram. The 16-percent decline year-on-year was caused about equally by a decline in quoted prices in Rupee and a weakening of the exchange rate.

The Indian jute industry is almost entirely focused on domestic demand, while half of total demand in Bangladesh comes from exports. Because of shortages of higher quality jute, export prices in Bangladesh are reportedly rising.

(https://www.wgc.de/en/produkte/jute)

India extended the anti-dumping duty at the end of December on jute and jute products imported from Bangladesh and Nepal for a period of five years. Bangladesh had urged the Indian government not to accept recommendations for extension, while the Indian industry was lobbying to ensure the duty remained in place. The duty rates range from approximately $6 per tonne at current exchange rates for low-quality fibres to $350 per tonne for finished products. The duty was originally imposed in January 2017 and was to expire at the end of 2022. - Prices of silk in China rose 2% during December to US$28.0 per kilogram. Prices in yuan fell marginally during the month, but the RMB rose 3% against the USD. Prices of textile-grade silk in China were essentially unchanged at the end of 2022 compared with the end of 2021. However, prices closed 2022 about 40% above the average level pre-Covid. https://www.sunsirs.com/uk/prodetail-322.html and https://businessanalytiq.com/procurementanalytics/index/raw-silk-price-index/ .

- Coconut coir fibre in India quoted in US$ remained in a narrow range, averaging $0.205 per kilogram in December. Prices in Rupee have been stable, and changes in dollar prices reflect changes in the exchange rate.

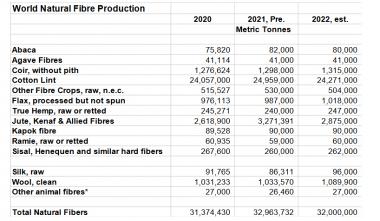

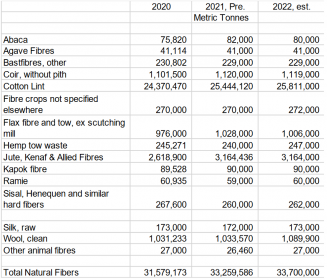

Production

World Natural Fibre Production in 2022 is estimated as of early January at 32 million tonnes, approximately one million below production in 2021 and down 900,000 tonnes compared with the estimate in early December.

World cotton production is estimated at 24.2 million tonnes in 2022/23 (August to July), 700,000 tonnes lower than in 2021/22 (ICAC.org). World cotton production rose from 20 million tonnes to 25 million between 2020/21 and 2005/06, but there has been no growth in the nearly two decades since.

World production of jute is forecast down nearly 400,000 tonnes in 2022 because of inadequate rainfall during the harvest period to permit proper retting. Production in India is estimated up by 100,000 tonnes to 1.7 million tonnes, but production in Bangladesh fell by nearly one-third to just one million tonnes.

Production of coir, flax and sisal in 2022 are each estimated based on recent trends. Coir and flax have each been trending upward over the past decade, while world sisal production has been largely stable.

World wool production is forecast up 5% in 2022 to 1.09 million tonnes (clean), the highest since 2018. The Australian Wool Production Forecasting Committee issued its third estimate of 2022/23 production in December, keeping the estimate unchanged from September. Above-average rainfall in Australia, and across most of the Southern Hemisphere, is resulting in better pasture conditions and a rebuilding of sheep numbers. Sheep numbers shorn in Australia are climbing from 67 million in 2020/21 to 72 million in 2021/22 and to an estimated 75 million in 2022/23. https://www.wool.com/market-intelligence/wool-production-forecasts/

According to the International Sericulture Commission (https://www.inserco.org/), silk production in China dropped from 170,000 tonnes in 2015 to 53,000 in 2020, with further declines estimated during Covid. Consequently, world silk production dropped from 202,000 tonnes in 2015 to 92,000 in 2020, and estimates of production during 2022 remain below 100,000 tonnes.

DNFI