Intertextile Shanghai Home Textiles returns for Autumn Edition 2023

Following a strong start at the Spring Edition of Intertextile Shanghai Home Textiles early this year, global industry players have turned their sights to the next international event in August. As the first Autumn Edition to be held in the wake of China lifting many of its pandemic-related border restrictions, the three-day fair will gather around 1,000 international and domestic exhibitors. Traders looking to meet market demand will be able to source from an extensive range of trending and specialised home and contract textile products from 16 – 18 August 2023.

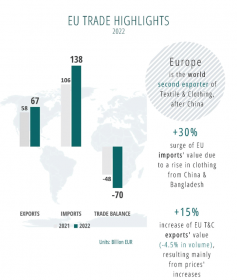

According to a recent market report, the global home textile market is expected to show a CAGR of 5.6% from 2023 – 2028 to reach USD 174.1 billion by the end of the forecast period. Asia-Pacific has dominated the global market in recent years, with China one of its most significant contributors.[1]

As a manufacturing hub for home textiles, China is gradually recovering from social and business disruptions caused by the pandemic. Speaking at the recent Spring Edition, Ms Rosemary Li, Domestic Sales Manager of Zhangjiagang Coolist Life Technology Co Ltd, a long-time exhibitor specialised in bio-based and functional bedding products, said: “Since China relaxed its pandemic-related control and prevention measures, after Chinese New Year we have been flooded with orders. With both domestic and export orders increasing, it has been almost impossible for the production line to fulfil the order demand.”

While the spring show’s promising visitor flow was a positive start to the Chinese home textile industry’s post-pandemic era, a higher participation of overseas exhibitors and buyers is expected at the upcoming Autumn Edition

The return of special zones and international pavilions

Later this year in Shanghai, exhibitors will showcase their most up-to-date home and contract textile products, ranging from bedding & towelling, rugs, table & kitchen linen, upholstery & curtain fabrics, editors, home textile technologies and textile design. With a wealth of choices for buyers, several show highlights are listed below:

- Editor & Designer Zone: located in hall 5.1, the zone will feature international, high-end editor and designer brands brought by leading exhibitors J&C, Julai, Qianbaihui, Prestigious, Shanghai Lotus, SohoCut, Yada, and more.

- Country and region pavilions: premium suppliers from Belgium, Türkiye and Taiwan (China) will exhibit quality products in their designated pavilions in hall 6.1.

- Textile Designs: textile design studios from Japan, Portugal and Taiwan (China), namely Amilia Design Studio, Fine Art Inc and Tela's Design Lda, will also showcase their seasonal designs in hall 6.1.

Adding to buyers’ sourcing options, a multitude of domestic players from different categories will also showcase their respective products. Highlighted exhibitors include top curtain and curtain fabric suppliers Fu-Tex, Hangzhou Aico, Hexin and Xiaoxuanchuang; bedding suppliers Coolist, Huizhou Wah Shing and Yantai North Home; as well as Hightex, Huatex, Maya and Suzhou Roufang from the upholstery and sofa fabric sector.

Fairgoers can also learn more about the upcoming global trends and designs by visiting the ‘2023 – 2024 Intertextile International Lifestyle Trend’ area. In aid of this, Intertextile Shanghai Home Textiles has joined forces with NellyRodi™, the renowned French forecasting agency, to present the design theme for 2023 – 2024: ‘ALIVE’. HUMAN CAPITAL, ROUSING COMMITMENT and UNREAL REALITIES are the theme’s three main trends.

[1] Globe Newswire: Global Home Textile Market Report 2023-2028: Increase in Consumer Spending on Home Renovation and Decoration Bodes Well for the Sector. https://www.globenewswire.com/en/news-release/2023/03/08/2622718/28124/en/Global-Home-Textile-Market-Report-2023-2028-Increase-in-Consumer-Spending-on-Home-Renovation-and-Decoration-Bodes-Well-for-the-Sector.html

Intertextile Shanghai Home Textiles Intertextile Shanghai Messe Frankfurt Interior textiles

Messe Frankfurt (HK) Ltd