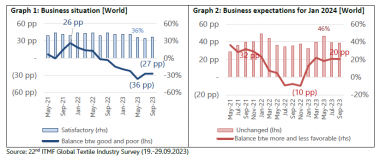

22nd ITMF Global Textile Industry Survey

- Business situation remains poor and unchanged

- Manufacturers show prudence in forecasting future developments

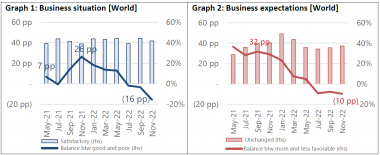

According to ITMF’s Global Textile Industry Survey (GTIS) conducted in the middle of September 2023, survey participants exhibited a cautious sentiment regarding the current business situation. The indicator for the business situation stood at -27 percentage points (pp, see Graph 1) because companies in the entire textile value chain were struggling with rising costs and weak demand. Business expectations have remained unchanged since July at around +20 pp (see Graph 2). They have jumped into positive territory in January 2023 based on the assumption that the Chinese economy would give an additional boost, but this hope did not materialise. The analysis indicates that a hard landing of the global economy is not in sight.

Order intake recovered in May 2023, but flattened in July and remained very weak in September (-28 pp). The entire textile value chain is running on minimum levels of orders. As long as brands and retailers do not increase orders, the entire value chain will continue struggling. Order backlog slightly increased globally, from 1.9 months in July to 2.2 months in September 2023. This indicator had been on a falling trend since the end of 2021. The average capacity utilisation rate dropped again globally (69%). Textile manufacturers expect this rate to remain low in six months’ time as well.

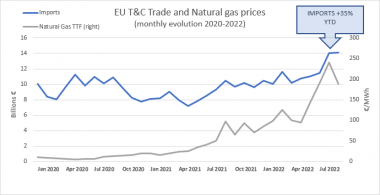

Weakening demand has been the major concern in the global textile value chain for a year. In September 2023, this concern grew even stronger due to high inflation rates measured in the last few months, a phenomenon fueled by high energy and high raw material prices. Nevertheless, participants seem not to be concerned by order cancelations and inventory levels remain average along the textile value chain.

ITMF