CEO Michael Steidle (Textildruckerei Mayer): Innovation Management in Swabian

- “Keep it up! is not an option"

The textile printing company Mayer is a family business on the Swabian Alb. As a leader in textile printing, in screen, rouleaux, rotary, sublimation and flock printing and as well as in 3D coating, the enterprise is increasingly applying its leading expertise to the field of technical textiles. An in-house quality management system ensures the traceability of all production processes, an environmental portfolio the efficient use of energy, sustainability and resources. Textination talked to Managing Director Michael Steidle.

Textildruckerei Heinrich Mayer GmbH is a family business that has been active in textile printing and finishing for 45 years. If you had to introduce yourself in 100 words to someone who doesn't know the company, what makes you unique?

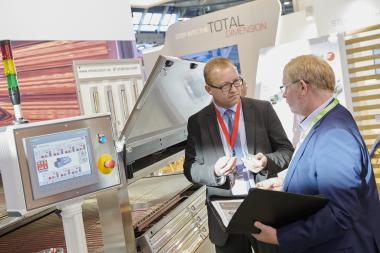

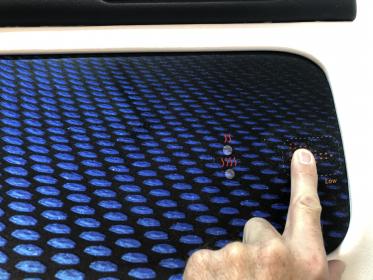

Over the past ten years or so, our family-owned company based in rural Baden-Wurttemberg has changed from a classic textile printing company into a system supplier. A central precondition for this is our knowledge of our own strengths. We rely on proven printing solutions. We do not rush into exchanging them with the latest trend. Instead, we examine whether another, innovative application can be found for them. Or whether one it is possible to combine the tried and tested with a new approach. For example, we were able to solve electronic requirements by printing technology. This area is our second focus. I am a Master of electronic engineering and completed my apprenticeship at Bizerba, a worldwide leading specialist in industrial weighing and labeling technologies. My wife brought me to the textile industry.

In which product area do market and customers challenge you in particular? And on which socially relevant areas do you see a particularly great need for innovation in the upcoming 10 years? What is your assessment that textile finishing will be able to offer solutions?

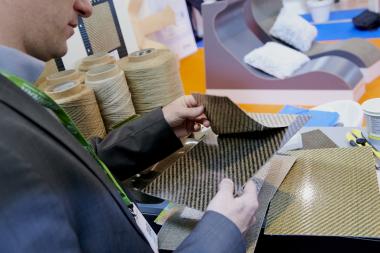

Mobility is an issue that will be of great concern to all of us in the coming years. In this area trump is what brings little weight, can be produced in a resource-saving way and is easy to shape. All these requirements are met by textile carrier materials and composites. However, textiles as a pure material are still not well-known in public and in our target industries. This understanding should be promoted.

Were fashion and clothing yesterday and do hybrid product developments like your ceramic-coated high-tech fabrics represent the future? When would the company name have to be adjusted, and how long will you keep your broad range of products and services?

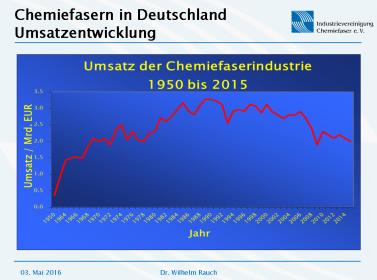

In any case, it is true that the textile market, especially the clothing sector, is becoming smaller and smaller in Germany, while the market for technical textile solutions is growing. Of course, this also has an impact on our business and our priorities. Textiles are now found in so many products - we would never have dreamed about before!

As far as the company name is concerned, we have discussed it extensively. We decided to keep it because it is still right. The textiles we talk about are mostly a functional material, but they still remain textiles. And the technology with which we manufacture our high-tech coatings continues to be the printing technology ...

"Without innovation no future" - In five years time, you celebrate the company’s 50th anniversary, with which fundamental corporate decisions will you then have secured the future of your customers and employees?

You already mentioned the landmark decision: "Innovation, innovation, innovation." We can secure our future through innovation only. This means that we must constantly question ourselves and be prepared to be widely interested in attending trade fairs and exhibitions and find out what people are looking for.

Innovation manager or tinkering: What does it mean for a medium-sized family business high up on the Swabian Alb having to profile on specialties in the niche? What advantages do you see compared to large companies?

The Swabian Alb is a traditional textile region. In 1980, about 30,000 people worked here in the textile industry. In 2005 it was barely a sixth. There is not much else left to do than to look for profitable niches and to show a clear profile. Perhaps the special thing about it is that we are not alone in this. Basically, all successful textile companies in our region have undergone a similar process.

As a small - and owner-managed - company, we have the shortest and fastest decision-making channels. That makes us more flexible than a big company. A budget is not questioned five times, but it is decided. If we make a trial, we can evaluate it in the evening and react the very next day. If something doesn't work, we don't need a meeting – then that's it.

At the same time, we do not automatically have a budget for research and development. We first have to carve this out elsewhere. And we do so in the knowledge that it can also be for the trash can. Within the framework of this budget, entrepreneurs have the greatest possible freedom.

To break new ground means decisiveness, overcoming fears - and thus the courage to fail. Not every project can succeed. Which entrepreneurial decision are you particularly glad to have made in retrospect? What makes you proud?

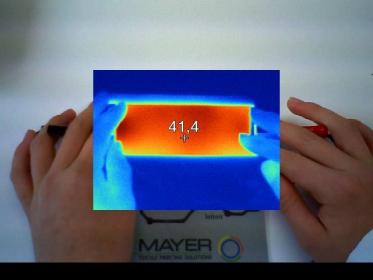

That's easy (Michael Steidle laughs)! We have realized a company’s request that has driven us for months, which in the end has also awakened personal ambition. That was the introduction to these technical coatings, the key and door opener for technical textiles in general. In doing so, I revived old resources, almost by chance. Meaning: my knowledge in electronics. That's when I realized that with a textile you can do completely different things. When you see the finished product on sale after two or three years, it makes the whole team proud!

Every man for himself, God for us all: With which sectors in the textile industry and from neighboring sectors do you want to get closer cooperation beyond competitive borders? For which higher-level problems do you consider this to be indispensable?

Actually, it is not so much a matter of competitive boundaries - cooperation with innovative competitors would always be good for the end product, but that is the case in every industry!

For us, cooperation with other companies in the textile chain is important, i.e. the upstream company. Let’s assume that I am looking for a special fabric for my coating, which in turn has to be made from a special yarn. Then I am already dependent on two companies. Fortunately, we have innovative companies right on our doorstep. But sometimes we have to go further to find the right partner. Characteristics such as willingness to take risks, a common entrepreneurial interest and a passion for the final product are enormously important in a successful cooperation.

Together with your customers, universities, specialist institutes and research institutes, porject-related you work on market-ready solutions. Do you think Germany is a good breeding ground for innovative entrepreneurs? What should happen to stay successful in international competition?

The cooperation with the institutes makes perfect sense; after all, it is their task to carry out research for companies that cannot shoulder such assignments on their own. This includes testing facilities as well as applying for funding, which is only possible in cooperation with research institutes. However, they are public institutions and therefore per se have a different objective than a company: We need to bring a promising idea to market as soon as possible so that it generates a return. A research institute does not have this pressure.

And Germany as a location? Germany is a brilliant location! But we have an infrastructure bottleneck: I mean roads and internet connections as well as access to funding or venture capital. That does not exist in Germany in the true sense anyway. Finding investors for an idea is therefore extremely difficult.

Let me give you an example: Over the years, I have received around 14,000 euros in subsidies for a coating innovation. An American entrepreneur had a very similar idea. He was able to raise about $ 35 million within three years through venture capital, crowd funding, and grants. In the end, he did not even know what he should spend the whole money on!

In addition, for us as a company in Germany, the large, open economic area of Europe is important!

You are the first textile printing company to be certified for screen printing as well as for rotary and rouleaux printing according to the GOTS standard. How important do you consider such certification as a unique selling point in the competition?

Such certifications are important because we work with clients in the upper and premium segments. Especially in times in which - undoubtedly justified - ever greater demands are placed on sustainable business and also the external presentation receives a steadily growing attention, we can support our clients this way. We therefore offer different printing methods, all of which are certified. One thing we have to be aware of is, that if we - and all the other members of the textile chain – charge the additional costs, the price mark-up would be so enormous that nobody would accept it anymore.

How do you feel about the willingness to perform of the succeeding generation? And who would you recommend to join the textile industry and to whom would you dissuade from it?

We work a lot with students and interns. Every year we give two students the opportunity to work and research in our company for their master's thesis. With these young talents, we often experience great commitment and the ambition to bring their own project to a meaningful completion. At the same time, it is difficult for us to fill our apprenticeships; the idea of working eight hours daily, five days a week seems daunting.

And who would I recommend to join the textile industry? For decades, we vehemently discouraged our offspring from working in the textile industry, because one said it has no future ... As a true high-tech industry, it is interesting for engineers, process engineers, chemists or electronic engenieers. Very important: for people with visions! If you are looking for the classic textile industry you have to be prepared to work worldwide and you will not be unemployed. Many companies are desperately looking for plant managers or managing directors for their non-European branches.

© Textildruckerei Heinrich Mayer GmbH, Claudia & Michael Steidle

© Textildruckerei Heinrich Mayer GmbH, Claudia & Michael Steidle

© Textildruckerei Heinrich Mayer GmbH

© Textildruckerei Heinrich Mayer GmbH

© Textildruckerei Heinrich Mayer GmbH

© Textildruckerei Heinrich Mayer GmbH

© Textildruckerei Heinrich Mayer GmbH

© Textildruckerei Heinrich Mayer GmbH

The interview was conducted by Ines Chucholowius, strategic consultant and managing director of Textination GmbH.