Nordic cooperation on circular innovation focusing on workwear

The University of Borås, Aalborg University Business School and Circular Innovation Lab have just started the 'North-South Circular Value Chains Within Textiles' project - an explorative project that aims at bridging textile brands in the Nordics with a strong focus on sustainability with innovative producers in the South.

Focus areas are Circular Value Chains (CVCs), Circular and resource-efficient textiles economy, Workwear and technical clothing, Sectors such as construction, energy, electronics and IT, plastics, textiles, retail and metals.

Made possible by a grant from the Interreg ÖKS programme, the first step is to create a specific economic, legal and technological framework allowing Scandinavian workwear companies to enter into close collaboration on circular solutions in the overall textile value chain and to prepare, and adapt their global value chains to the upcoming EU regulations on circular economy.

Recently, the consortium partners convened for an initial meeting at The Swedish School of Textiles to discuss the project framework, which is a feasibility study intended to lead to a multi-year project involving workwear companies in the Öresund-Kattegat-Skagerrak (ÖKS) region, including their supply chains in Asia.

Kim Hjerrild, Strategic Partnerships Lead at the Danish think tank Circular Innovation Lab, Copenhagen, explained: "The goal is to assist workwear producers in Denmark, Sweden, and Norway in becoming more sustainable through circular product design, production, and service concepts. We are pleased to have The Swedish School of Textiles lead the project as they have a strong tradition of collaborating with textile companies."

Complex branch

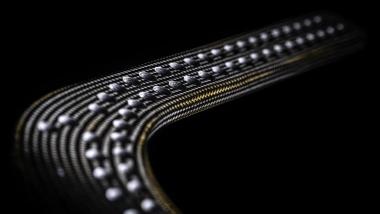

The decision to focus specifically on workwear stems from it being a complex part of the textile industry, demanding strict standards, certifications, safety aspects, and specific functions depending on the application area, such as specific high-performance environments, healthcare, and hospitality. "To future-proof their operations, companies need to become more resource efficient and circular by producing durable and long lasting workwear that can be repaired and reused. Additionally, they must reduce their carbon footprint per product, as well as minimize problematic chemical usage, and increasingly use recycled materials" explained Kim Hjerrild.

Wants to provide companies with tools and knowledge

Apoorva Arya, founder and CEO of Circular Innovation Lab, elaborates: "Our first and primary goal is to equip Scandinavian workwear companies with tools and knowledge in order to comply with the upcoming EU directives and policies. This includes regulations on product-specific design requirements to labour conditions for employees, human rights, all the way from production to third-party suppliers. Ensuring these companies, especially their suppliers, can transition to a circular supply chain, and navigate the legislative landscape, while guaranteeing competitiveness in the global market."

Focus on new structures

Rudrajeet Pal, Professor of Textile Management at The Swedish School of Textiles, is pleased that the university can be the coordinator of the project. "From the perspective of my research group, this

is incredibly interesting given the focus on the examination and development of ‘new’ supply chain and business model structures that would enable sustainable value generation in textile enterprises, industry, and for the environment and society at large. We have conducted several projects where such global north-south value chain focus is eminent, and this time particularly in workwear companies’ value chain between Scandinavia and Asia. We are delighted to contribute expertise and our experience of working internationally."

About the pre-project North-South Circular Value Chains Within Textiles, NSCirTex

The project aims to support the circular transition in the Nordics by setting up a shared governance model to enable pre-competitive collaboration and the design of circular value chains between Scandinavian workwear companies in the ÖKS-region and producers in India, Bangladesh, Vietnam, and Türkiye.

The next step is to achieve a multi-year main project where workwear companies with their suppliers in Asian countries, can test tailored models for shared governance as a way to develop practical circular solutions, such as post-consumer recycling, circular material procurement, develop safe and resource efficient circular products, enhance social sustainability and due diligence, among others. The main project will thus develop solutions to reduce material footprint, and resource usage while generating both commercial viability and prepare for new regulation, reporting, and accountability.

Partners in this feasibility study: University of Borås, Aalborg University Business School, and Circular Innovation Lab. The feasibility study is funded by the EU through the Interreg Öresund-Kattegat-Skagerrak European Regional Development Fund.

University of Borås, Solveig Klug