Study tests firefighter turnout gear with, without PFAS

Transitioning away from per- and polyfluoroalkyl substances (PFAS), which offer water- and oil-repelling properties on the outer shells of firefighter turnout gear, could bring potential performance tradeoffs, according to a new study from North Carolina State University.

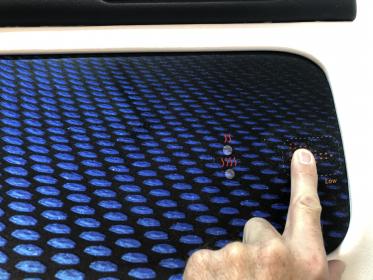

The study showed that turnout gear without PFAS outer shell coatings were not oil-repellent, posing a potential flammability hazard to firefighters if exposed to oil and flame, said Bryan Ormond, assistant professor of textile engineering, chemistry and science at NC State and corresponding author of a paper describing the research.

“All oil repellents can also repel water, but all water repellents don’t necessarily repel oil,” Ormond said. “Diesel fuel is really difficult to repel, as is hydraulic fluid; in our testing, PFAS-treated materials repel both. In our tests, turnout gear without PFAS repelled water but not oil or hydraulic fluid.

“Further, oils seem to spread out even more on the PFAS-free gear, potentially increasing the hazard.”

PFAS chemicals – known as forever chemicals because of their environmental persistence – are used in food packaging, cookware and cosmetics, among other uses, but have recently been implicated in higher risks of cancer, higher cholesterol levels and compromised immune systems in humans. In response, firefighters have sought alternative chemical compounds – like the hydrocarbon wax coating used in the study – on turnout gear to repel water and oils.

Besides testing the oil- and water-repelling properties of PFAS-treated and PFAS-free outer garments, the NC State researchers also compared how the outer shells aged in job-related exposures like weathering, high heat and repeated laundering, and whether the garments remained durable and withstood tears and rips.

The study showed that PFAS-treated and PFAS-free outer shells performed similarly after exposure to UV rays and various levels of heat and moisture, as well as passes through heating equipment – similar to a pizza oven – and through washing machines.

“Laundering the gear is actually very damaging to turnout gear because of the washing machine’s agitation and cleaning agents used,” Ormond said.

“We also performed chemical analyses to see what’s happening during the weathering process,” said Nur Mazumder, an NC State doctoral student in fiber and polymer science and lead author of the paper. “Are we losing the PFAS chemistries, the PFAS-free chemistries or both when we age the garments? It turns out that we lost significant amounts of both of these finishes after the aging tests.”

Both types of garments performed similarly when tested for strength against tearing the outer shell fabric. The researchers say the PFAS and PFAS-free coatings didn’t seem to affect this attribute.

Ormond said that future work will explore how much oil repellency is needed by firefighters out in the field.

“Even with PFAS treatment, you see a difference between a splash of fluid and soaked-in fluid,” Ormond said. “For all of its benefits, PFAS-treated gear, when soaked, is dangerous to firefighters. So we need to really ask ‘What do firefighters need?’ If you’re not experiencing this need for oil repellency, there’s no worry about switching to non-PFAS gear. But firefighters need to know the non-PFAS gear will absorb oil, regardless of what those oils are.”

Andrew Hall, another NC State doctoral student in fiber and polymer science and co-author on the paper, is also testing dermal absorption, or taking the aged outer shell materials and placing them on a skin surrogate for a day or two. Are outer shell chemicals absorbed in the skin surrogate after these admittedly extreme exposure durations?

“Firefighting as a job is classified as a carcinogen but it shouldn’t have to be,” Ormond said. “How do we make better gear for them? How do we come up with better finishes and strategies for them?

“These aren’t just fabrics,” Ormond said. “They are highly engineered pieces of material that aren’t easily replaced.”

The paper appears in the Journal of Industrial Textiles. Funding for the research came from the Federal Emergency Management Agency’s Assistance to Firefighters Grants Program.

North Carolina State University, Mick Kulikowski