DOWNPASS e.V.’s FIRST TRADE FAIR IN CHINA

- The association's zero tolerance standard was presented at Intertextile Shanghai Home Textiles between 14 and 16 March

- The association enjoyed a successful appearance together with three certification bodies from Germany, Japan and the US/China

- Chinese manufacturers showed great interest in the unique combination of animal welfare and quality control

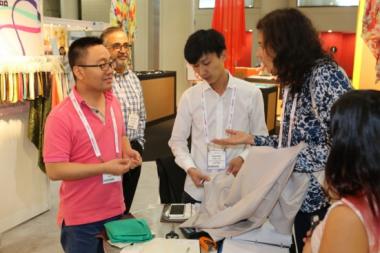

‘We met many committed companies – primarily from China – that showed great interest in traceability and the ethically sound sourcing of feathers and down. The potential that Downpass offers as a traceability standard together with continuous quality control was clearly recognised and won companies over not only for export-oriented purposes, but also for the domestic Chinese market’, explained Dr Juliane Hedderich, who was responsible for the trade fair appearance as managing director of Downpass e.V.

‘The follow-up after the trade fair will be crucial to translate Chinese companies’ interest into actual memberships.’

The association's representatives and rotating teams from the certification bodies Wessling, QTEC and IDFL advised visitors at a large stand in the foyer of hall 4.2 (HOME) with a deliberately puristic design. These independent testing institutes and auditing organisations are companies’ direct contacts for audits and product monitoring. As is common for trade fairs, the largest crowds were seen on the afternoon of the first and second day of the event.

The markets are increasingly demanding materials that guarantee trading partners and therefore consumers the greatest possible security when it comes to ethics and sustainability, alongside high product quality. Products certified by independent testing institutes gain in importance and set sales standards.

Ms Anna Elisa Wessling, legal representative of the subsidiary Wessling Consulting (Shanghai) Ltd. and representative of the German Wessling Group at the trade fair, was happy to engage with customers directly, explaining, ‘our presence as a consulting, analysis and testing company at Intertextile Home gave us the opportunity to talk to visitors and thus allowed us to increase transparency on the Chinese market such that retailers and consumers are suitably informed of the highest requirements of product quality and of the origin of bedding filled with feathers and down.’

As a German family company, the Wessling Group has stood for continuous improvement in the quality and security of products and processes for 35 years and is set to move into new, larger premises for its subsidiary in Shanghai in the near future so that it can fulfil the increasing number of testing requests in Asia with a larger team.

‘We expect constant growth in our analysis and consulting segment feathers and down, especially as our international customers see Downpass as a clear advantage for customer acquisition domestically and abroad. As an independent testing institute, we play a substantial role in underpinning trust in the Downpass brand’, highlighted Ms Weßling.

The Japanese institution QTEC also confirmed Downpass’ high level of visitor interest and, like its colleagues, stressed the importance of an institute’s independence. The managing director of Shanghai QTEC Testing Laboratory, Hiroyuki Nakamoto, who successfully presented the company’s three Chinese sites – including Shanghai and Wuxi – at the home textiles trade fair, explained, ‘our knowledge of the Japanese market, together with our testing expertise, make us a top contact for manufacturers of bedding and clothing products filled with feathers and down to ensure the supply chain is ethically sound.’ The institute expects a steady rise in the number of testing requests for Downpass, especially at Chinese sites.

A large, bilingual English-Chinese sales team from IDFL China, based in Hangzhou was available at the trade fair in Shanghai to answer all questions relating to audits and testing procedures with its varied specialist expertise. Together with its cooperation partner, the Chinese national down and feather laboratory CIQ Xiaoshan, IDFL has capacities for a broad range of different tests and audits.

IDFL’s Global Audit Manager Bryan Mortensen highlighted that Downpass had become a standard and therefore a seal that is recognised worldwide and in China in particular. The joint appearance with other certification bodies provided the opportunity to answer the questions of Chinese companies along the supply chain, from wholesalers to clothing and home textile brands and trading partners.

‘We are seeing strong demand for the current version of the standard, Downpass 2017, and its seal. IDFL carried out numerous audits across the globe in 2017 and we receive new requests every day. Overall we anticipate a successful future for Downpass in the down and feather industry’, explained Mortensen. IDFL – which will celebrate 40 years in the industry in 2018 – has been carrying out audits in the field of down and feathers for more than 10 years and is currently undergoing certification in accordance with ISO/EN 17065 and 19011.

In their first summary of the event, the extended Downpass trade fair team took stock of a successful trade fair premiere. ‘We aim to promote the sustainable use of natural resources across the globe and to increase transparency in the supply chain’, explained Dr Juliane Hedderich. ‘Animal welfare and guaranteed product quality are our hallmarks. We did a great job in Shanghai of jointly informing others about these and finding new collaborators.’

About the zero tolerance standard DOWNPASS 2017

Products filled with feathers and down that are certified in accordance with Downpass 2017 exclude products sourced from live plucking and production based on force feeding. The animals’ rearing is monitored and monitoring may be extended to the parent animal farms.

To this end, farms, commodities traders and producers are subject to audits and monitoring.

Pre-made products are bought by mystery shoppers at the point of sale and subsequently undergo quality control in independent testing laboratories.

As of January 2018, 503 million animals had been audited in accordance with DOWNPASS 2017.

Labelled products are available in North America, Europe and Asia.

Traumpass e.V.