IW Association Survey: Textile industry and Banks particularly pessimistic

Things can only get better

At the turn of the year, the German Economic Institute (IW) traditionally asked German associations about their economic expectations for the coming year. Most industries are reporting incisive difficulties and are hoping for an improvement in 2021. However, many companies will cut jobs - especially where there were have been already problems before the pandemic started.

At the end of the year, the German economy looked back on one of the most difficult years in recent history. The Covid-19 pandemic already hit many companies in spring 2020, and the current winter and the second wave have put struggling sectors under further strain. It is still not possible to predict when the situation will noticeably improve. This is also reflected in the traditional IW association survey: 34 of 43 associations interrogated reported a worse economic situation than the year ago. Those reporting an improved or unchanged position were often already in a difficult economic situation in the previous year. These include, the automotive and chemical industries respectively.

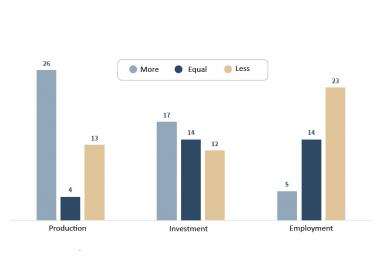

Four out of five companies in Germany at the turn of 2020/2021 judge the mood even worse than a year before. This crisis-prone initial position partly explains in general optimistic business expectations for 2021. According to the IW’s association survey, higher economic activity is expected in 26 of 43 sectors. By contrast, 13 associations expect a decrease in production in 2021. While there is a moderate recovery in investments overall, employment is expected to decline further in 23 sectors.

Looking ahead to 2021, the IW Association Survey is dominated by confidence. This is not surprising understanding this confidence as an improvement on the crisis year 2020. The expected increases can be explained having the massive drop in view as well as a poor starting point in 2020. For a number of companies and entire industries, this hopeful outlook for 2021 does not necessarily mean a return to pre-crisis production levels. The IW business survey with more than 2,200 companies conducted in November 2020 consistently shows, that around half of the companies surveyed still expect shortfalls in production by 2022 compared to the pre-crisis level (IW Research Group Macroeconomic Analysis and Business Cycle, 2020).

Textile industry and banks particularly pessimistic

After all, most associations are confident with a view to 2021, expecting their situation to improve - although the pre-crisis level is not yet in sight for many sectors. 26 associations are planning increased production for the coming year. 13 associations - including shipbuilding and marine technology, textile and fashion associations, and the food industry - predict lower production. Banks and construction companies also have subdued expectations for 2021, although the pandemic has had relatively little impact on these industries up to now.

Less jobs in the automotive industry

The outlook for the employment market is less optimistic: Only five of 43 associations surveyed expect their member companies to employ more people in the coming year. This includes the construction industry and handicraft businesses, which already suffered from a shortage of skilled workers before the crisis. 23 associations expect a reduction in employment, especially for industrial site. Particularly pessimistic are associations with member companies facing structural adjustment burdens in addition to the corona pandemic – like in the area of finance:

In the previous years, fewer and fewer customers used branches of banks. The automotive industry is also planning with fewer employees: In addition to the weak global economy, are strict exhaust emission limits and quotas for electric mobility put companies under pressure. Exports, which are extremely important for the industry, decreased by a similar amount.

The few industry associations whose members - on average across all enterprises and subsectors - are in the same or better position than at the previous turn of the year, are often sectors that were already in a difficult economic situation at the turn of 2019/2020. The automotive industry, segments of the metal and electrical industry as well as the chemical industry point to this. The Covid-19 crisis already records a negative history for parts of the industry. 2019 the downturn in business was partly the result of a cyclical normalization after a phase of high capacity utilization. Above all, protectionism and geopolitical uncertainties weighed on global investment activity, and hit the German industry, which is heavily involved in the international capital goods business. Technological challenges - due to digitization and climate change for example - also created adjustment burdens.

German Economic Institute, Prof. Michael Grömling Head of the Macroeconomic Analysis and Business Cycle Research Group