INVENTING TECHNOLOGIES NO ONE CAN COPY… I.S.T

NEW HIGH-TECH FIBERS AND YARNS FOR THE SPORTS AND LEISURE MARKET

With its trade fair premiere at this year's ISPO Munich at the end of January, a newcomer in the sportswear and outdoor market has achieved a well-received appearance: For the first time in Europe, the Japanese company I.S.T Corporation presented its new high-tech fiber and a spinning technology with amazing possibilities at their booth with extensive augmented reality technology. In the sports industry, I.S.T is only known to a few, although there have been first cooperations with well-known manufacturers such as Patagonia in the last seasons.

The CEO and president, Ms. Toshiko “Toko” Sakane, answered Textination's questions. She has been running the company - founded by her father - since November 2016. After completing her bachelor's degree in sociology / human sciences, she worked in the office of the House of Representatives of the Japanese Parliament and the former Japanese Minister of Health and Social Affairs. Later she was managing director of the I.S.T Corporation in Parlin, New Jersey, USA, founded in 2000 - a manufacturer of unique, high-temperature resistant resin materials.

I.S.T is a Japanese company with a comparatively young history. Originally founded in 1983 as an R&D company, you are now also based in the United States and in China. If you had to introduce yourself in 100 words to someone who doesn't know the company: What makes you unique?

I.S.T Corporation is an R&D-oriented Japanese material company with the claim to "invent technologies that no one can imitate". What makes us uniquely competent is our integrated process of material development, innovating our own in-house production methodologies and advancing production technologies. Through this end-to-end cycle, we can achieve various advantages including developing complete original products, securing best quality assurance, and, most importantly, letting us discover new innovations. I.S.T is committed to keep innovating new technologies so they can contribute to enriching people’s lives more.

Your slogan is: make the impossible possible. In which markets and from which industries do you feel particularly challenged? And with which product innovations for the textile industry do you think you can move the most?

I.S.T’s focus is sporting goods and apparel industry because materials used in this industry demand a wide variety of functionalities and are likely used in extreme conditions. We find it challenging and exciting to offer our advanced innovations. As for the textile industry, we believe our KARL KARL™ spinning technology offers a new great solution for winter active inner wears because it offers all the functions they want, such as warmness, being light-weighted, and easy-care.

A central guideline of the company is the motto "Inventing technologies no-one can copy". Patent protection and a consistent brand policy characterize your activities in the market. But patents can expire and brands can be copied, what makes you uncopiable?

A patent or brand can be copied. However, what makes it impossible to copy us is that our core technologies are embedded throughout our integrated process of material development, in-house production methodologies and advancing production technologies. For example, our KARL KARL™ technology is spinning technology that offers multiple functionalities in one yarn and also can be applied to all different types of and hybrid yarns.

There are some other companies that claim their yarns having a similar function with ours, but those are single function and in a particular type of yarn. This is the most fundamental and significant difference between technologies and competitors. Other companies may be able to copy a single function from us, but it will never be the same as our products that are the results of layers and layers of our integrated innovations.

Initially focused on selling technology, you are now a major fiber producer yourself. In addition, you have expanded your portfolio in the past 15 years - for example in the wool market - through acquisitions in Japan and China. Where do you see I.S.T as a player in the textile sector in 2030?

Just as you see a GORE-TEX tag on any outerwear, I would like to see brand names produced by I.S.T on every sports and fashion apparel and people instantly recognize it as the sign of most advanced functional materials.

For the first time you attended ISPO Munich 2020 in January as an exhibitor to present the high-tech fiber IMIDETEX® and new KARL KARL™ yarns to the sporting goods and outdoor industry. What is so special about these two products and what makes them so suitable for use in these markets?

IMIDETEX®, made of 100% polyimide resin and commonly used in outer space, has possess various advantageous characteristics that other existing super fibers couldn’t overcome, including it being high UV resistant, heat resistant, low water absorption, and has a high tensile strength.

Examples of possible applications for the outdoor market as in composites, would include highly resistive but also durable golf shafts or tennis rackets that can minimize the impact sent to players, and a bicycle that can absorb the shock from the ground throughout a long and competitive race. As for textile, it makes an incredibly durable sail that endures an unforgiving sun. Finally, as yarns IMIDETEX® makes a light-weighted but super strong ropes that people can trust their lives with. IMIDETEX® can provide great performances in extreme natural conditions.

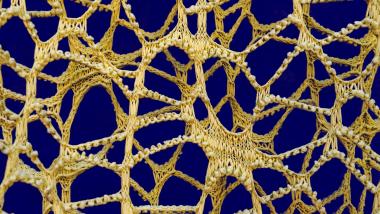

KARL KARL™ is the patented spinning technology that multiplies one core thread with another thread. By expanding the yarn structure itself, it achieves lightness and warmness, which are two seemingly opposite characters to coexist. This technology can be applied to wool, cotton, silk, polyester, nylon … plus there are endless possibilities of developing new yarns by combining different characteristic yarns.

These materials by I.S.T are unrivaled and present infinite possibilities for richer designs in sports fashion scenes.

In a world in which great value is placed on nature and natural materials, man-made fibers are not always welcome. On your website you postulate, I.S.T contributes to the people around the world through chemistry for a better life style. Which aspects make a good case for that?

Our brand-new product, faux-fur, made with KARL KARL™ technology is a good example of our contribution to keep the good balance of natural and synthetic.

The real fur is fashionable but it’s a symbol of animal abuse nowadays. To conserve the nature, our KARL KARL™ faux-fur offers an alternative to fashion, while preventing polluting the ocean from using micro fibers.

In which socially relevant subject areas do you see a particularly great need for innovation and action during the next 5 years? What is your assessment that your company will be able to offer solutions for this with its products?

We believe that light-weight is a major key factor for better lives and the planet because it allows to save energies and expand the performances.

As the first step, we are bringing in our light-weight technologies, such as IMIDETEX® composites and KARL KARL™ technology, to sporting gears and apparels to support our active lifestyle before extending those technologies to all other markets that can benefit from them.

There are various definitions for sustainability. Customers expect everything under this term - from climate protection to ecology, from local on-site production to the exclusion of child labor etc. What do you do to bring this term to life for your company and what activities or certifications do you rely on?

I.S.T's taking this subject seriously in any aspects. We aggressively approach to research and develop technologies and materials that can support human lives and planet, as well as bringing in sustainable methods and materials to our operations. For instance, we are developing a yarn making from cellulose taken out of used papers without using any harmful chemicals to humans. Also, we invested in a state-of-the-art low emission production facility to make Polyimide materials.

We are RWS (Responsible Wool Standard) certified yarn spinner as far as wool is concerned and we are using RWS certified wool fiber. As for polyester, we are using GRS (Global Recycled Standard) certified recycled polyester and as for cotton, we are using organic cotton fiber. Moreover, our company values producing materials that last forever and not to produce any wastes and/or one-time use materials.

Where do you get your inspiration from to research certain technologies or products? Which orders or inquiries from the textile supply chain play a decisive role?

You may think that our life is already filled with things and there isn’t a thing that we cannot get in this world. And yes, we have everything. Yet there are some functions you wish you had in addition to full of those things.

The original idea of developing KARL KARL™ technology was that we wanted to adapt functions like lightness, warmness, quick-drying and easy-care that synthetic fibers have, into natural fibers such as wool and cotton because, obviously natural fibers are much friendlier to human and the earth than petroleum-based fibers.

We believe in and keep our corporate missions: “Develop and manufacture products no others have tried before” and “Handle high-value added products”. Our inspirations for R&D come from our belief, “bringing a wish into a reality”. We do not get an inspiration from others. Our innovations inspire customers and the market.

Breaking new ground means willingness to make decisions, overcoming fears - and thus courage to fail. Not every project can succeed. In retrospect, which entrepreneurial decision are you particularly happy to have made?

Actually, for us, there is no such thing as failed projects because we never give up until each and every project becomes successful.

By carrying on our original corporate missions of “Develop and manufacture products no others have tried before” and “Confront difficulties” that my father, the founder of I.S.T, established almost forty years ago, I.S.T members including myself have learned the joy of overcoming problems and of feeling the victory.

When I took over the business, I have set my goal to “move forward to the global market to inspire the world with our technologies”.

Most recently, by making the decision to enter the sporting gears and apparel market and receiving very positive responses at the ISPO Munich 2020, I’m very pleased that we have made one step forward toward my goal.

The interview was conducted by Ines Chucholowius, CEO Textination GmbH