Composites' hopes are pinned on wind energy and aviation sectors

Composites Germany - Results of the 22nd Composites Market Survey

- Critical assessment of the current business situation

- Future expectations brighten

- Investment climate remains subdued

- Different expectations of application industries

- Growth drivers with slight shifts

- Composites index points in different directions

For the 22nd time, Composites Germany has collected current key figures on the market for fiber-reinforced plastics. All member companies of the supporting associations of Composites Germany: AVK and Composites United as well as the associated partner VDMA were surveyed.

In order to ensure that the different surveys can be compared without any problems, no fundamental changes were made to the survey. Once again, mainly qualitative data was collected in relation to current and future market developments.

Critical assessment of the current business situation

After consistently positive trends were seen in the assessment of the current business situation in 2021, this has slipped since 2022. There is still no sign of a trend reversal in the current survey. The reasons for the negative sentiment are manifold and were already evident in the last survey.

At present, politicians do not seem to be able to create a more positive environment for the industry with appropriate measures. Overall, Germany in particular, but also Europe, is currently experiencing a very difficult market environment.

However, the main drivers of the current difficult situation are likely to be the persistently high energy and commodity/raw material prices. In addition, there are still problems in individual areas of the logistics chains, for example on the main trade/container routes, as well as a cautious consumer climate. A slowdown in global trade and uncertainties in the political arena are currently fueling the negative mood in the market.

Despite rising registration figures, the automotive industry, the most important application area for composites, has not yet returned to its former volume. The construction industry, the second most important key area of application, is currently in crisis. Although the order books are still well filled, new orders are often failing to materialize. High interest rates and material costs coupled with the high cost of living are having a particularly negative impact on private construction, but public construction is also currently unable to achieve the targets it has set itself. According to the ZDB (Zentralverband Deutsches Baugewerbe), the forecasts in this important sector remain gloomy: "The decline in the construction industry is continuing. Turnover will fall by 5.3% in real terms this year and we expect a further 3% drop next year. Residential construction remains responsible for the decline, which will slump by 11% in real terms this year and continue its downward trajectory at -13% in 2024."

It is not only the assessment of the general business situation that remains pessimistic. The situation of their own companies also continues to be viewed critically. The picture is particularly negative for Germany. Almost 50% of respondents are critical of the current business situation in Germany. The view of global business and Europe is somewhat more positive. Here, "only" 40% and 35% of respondents respectively assess the situation rather negatively.

Future expectations brighten

Despite the generally rather subdued assessment of the business situation, many of those surveyed appear to be convinced that the mood is improving, at least in Europe. When asked about their assessment of future general business development, the values for Europe and the world are more optimistic than in the last survey. The survey participants do not currently expect the situation in Germany to improve.

Respondents were more optimistic about their own company's future expectations for Europe and the global market.

The participants seem to be assuming a moderate short to medium-term recovery of the global economy. The forecasts are more optimistic than the assessment of the current situation. It is striking that the view of the German region is more critical in relation to Europe and the global economy. 28% of those surveyed expect the general market situation in Germany to develop negatively. Only 13% expect the current situation to improve. The figures for Europe and the world are better.

Investment climate remains subdued

The current rather cautious assessment of the economic situation continues to have an impact on the investment climate.

While 22% of participants in the last survey still assumed an increase in personnel capacity (survey 1/2023 = 40%), this figure is currently only 18%. In contrast, 18% even expect a decrease in personnel.

The proportion of respondents planning to invest in machinery is also declining. While 56% of respondents in the last survey still expected to make such investments, this figure has now fallen to 46%.

Different expectations of application industries

The composites market is characterized by a high degree of heterogeneity in terms of both materials and applications. In the survey, the participants are asked to give their assessment of the market development of different core areas.

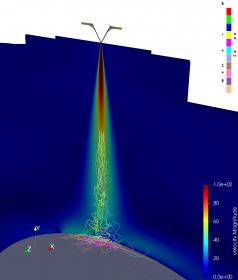

The expectations are extremely varied. The two most important application areas are the mobility and construction/infrastructure sectors. Both are currently undergoing major upheavals or are affected by declines, which is also clearly reflected in the survey. Growth is expected above all in the wind energy and aviation sectors.

Growth drivers with slight shifts

In terms of materials, there has been a change in the assessment of growth drivers. While the respondents in the last 9 surveys always named GRP as the material from which the main growth impetus for the composites sector is to be expected, the main impetus is now once again expected to come from CFRP or across all materials.

There is a slight regional shift. Germany is seen less strongly as a growth driver. In contrast, Europe (excluding Germany) and Asia are mentioned significantly more.

Composites index points in different directions

The numerous negative influences of recent times continue to be reflected in the overall Composites Index. This continues to fall, particularly when looking at the current business situation. On the other hand, there is a slight improvement in expectations for future market development, although this remains at a low level.

The total volume of processed composites in Europe in 2022 was already declining, and a further decline must also be expected for 2023. This is likely to be around 5% again.

It remains to be seen whether it will be possible to counteract the negative trend. Targeted intervention, including by political decision-makers, would be desirable here. However, this cannot succeed without industry/business. Only together will it be possible to maintain and strengthen Germany as a business/industry location. For composites as a material group in general, there are still very good opportunities to expand the market position in both new and existing markets due to the special portfolio of properties. However, the dependency on macroeconomic developments remains. It is now important to develop new market areas through innovation, to consistently exploit opportunities and to work together to further implement composites in existing markets. This can often be achieved better together than alone. With its excellent network, Composites Germany offers a wide range of opportunities.

The next composites market survey will be published in July 2024.

Composites Germany