Funding Project Raw Material Classification of Recycled Fibers

For centuries, old textiles have been used to make tear fibers and processed into new textile products. This effective recycling is one of the oldest material cycles in the world. Today, it is not only clothing that is recycled, but also high-quality technical textiles. As the products of the textile industry evolve, so do the demands on textile recycling. The basis for this is a clear assessment and classification of raw materials.

In the research project of the German Institutes of Textile and Fiber Research Denkendorf (DITF) and the Sächsisches Textilforschungsinstitut e.V. (STFI - Saxony Textile Research Institute), a methodology is being developed that will make it possible to analyze the tearing as well as the subsequent processes with regard to fiber quality. The systematic analysis should make it possible to optimize the subsequent spinning processes in such a way that the recycled content of the yarn can be increased without the yarn properties differing significantly from those of a yarn consisting of 100% good fibers. These yarns can then be processed into sustainable textile products such as clothing or composite components.

The project, which is funded by the BMWi/IGF, is scheduled to run for two years and will end on December 31, 2022. The main benefits for the participating companies are to enable them to make greater use of secondary raw materials, to open up new markets through technologies or products developed in the project, to initiate synergies and long-term cooperation, and to prepare a joint market presence.

The project includes several steps:

- Material selection and procurement

Cotton fibers to be processed are obtained from used textiles (T-shirts) and waste from the cotton spinning mill. Aramid fibers are processed from used protective clothing and technical textiles. - Optimization of the preparation / dissolution of the textiles

To ensure that the fibers are detached from the corresponding textiles as gently as possible and with a not too high reduction, exact settings have to be found for the tearing process, which are technologically very demanding and require a lot of experience. - Determination of the quality criteria for the evaluation of the fiber dissolution

In order to define the quality criteria, the fibers coming from the tearing mill are determined by means of an MDTA-4 measuring device from Textechno GmbH & Co. KG. The criteria determined are to be used to characterize the (lowest possible) fiber shortening caused by the tearing process. - Determination of optimized settings in the spinning process

In order to determine the optimum settings for producing a yarn from the recycled fibers, they are spun after the rotor spinning process. By adjusting the spinning process, the aim is to produce a yarn that has good uniformity and also appropriate firmness. - Production and comparison of yarns from recycled raw materials

In order that the recycled fibers - consisting of aramid and cotton - can each be used to produce an area-measured material, the material is to be processed at industrial scale. For this purpose, the fibers are processed over a complete blowroom line with following sliver production over adapted cards. After drawing and the following roving production, yarns are produced according to the rotor or ring spinning process. The finished yarns are used to produce knitted fabrics. - Coordination, analysis of results and preparation of reports

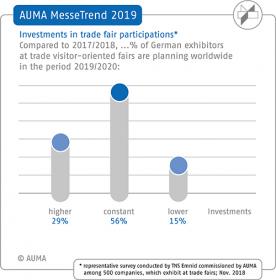

The final report is prepared by the DITF and the STFI. The results will be transferred through publications, technical information to associations and trade fair presentations. Regular meetings with the participating companies are planned.

Textination spoke with Stephan Baz, Deputy Head of the Competence Center Staple Fiber, Weaving & Simulation, Head of Staple Fiber Technology and Markus Baumann, Research Associate at the Competence Center Staple Fiber, Weaving & Simulation (both DITF) as well as Bernd Gulich, Head of Department Nonwovens/Recycling and Johannes Leis, Research Associate Focus Nonwovens/Recycling (both STFI) about the current status of the funding project.

What is the current status of the project?

We are currently in the phase of carrying out trials and the iterative optimization of several project components. As expected, several loops are necessary for the mechanical preparation itself and also for the adjustment of the spinning process with the different variants. Ultimately, after all, the project aims at coordinating the processes of mechanical preparation and spinning as processing in order to achieve optimum results. At the same time, determining the quality criteria of the fibers produced is not trivial. This also requires the further development of processes and test methods that can be implemented productively in industry and that allow the quality of the fibers produced to be assessed effectively and unaffected by residual yarns, for example. What is really remarkable is the interest and willingness of the industry to drive the project work forward. The considerable quantities of materials required for our trials were purchased from ReSales Textilhandel und -recycling GmbH, Altex Textil-Recycling GmbH & Co. KG and Gebrüder Otto GmbH & Co. KG. Furthermore, with Temafa Maschinenfabrik GmbH, Nomaco GmbH & Co. KG, Schill + Seilacher GmbH, Spinnerei Neuhof GmbH & Co. KG and Maschinenfabrik Rieter AG, many members of the project-supporting committee are actively involved in the project, from consulting to the providing of technologies. The company Textechno Herbert Stein GmbH & Co. KG has provided a testing device of the type MDTA4 for the duration of the project and supports our work with regard to the evaluation of the mechanically prepared fibers. We are of course particularly pleased about this, as it has allowed us to look at and analyze several technologies in both mechanical preparation, testing and spinning. We expect to be able to make more detailed statements at the beginning of the coming year.

Which approaches do you think are particularly promising?

With regard to technologies, we must refer to the evaluation and analysis of the trials, which are currently still ongoing. We will be able to go into more detail in the first quarter of next year.

Of course, things are already emerging. With meta-aramid waste, promising approaches could be found very quickly; with post-consumer cotton, this is considerably more complex. Obviously, there is a link between the quality of the raw material and the quality of the products. In some cases, we have already been able to determine very low average fiber lengths in the procured goods; to a certain extent, these are of course directly reflected in the output of our processes. From this, and this is not a new finding, a great importance of the design of the textiles is again derived.

What are the challenges?

In addition to the expected high short fiber content, the residual yarns after the tearing process are an issue of particular focus. The proportion of these residual yarns can vary between the materials and preparation technologies, but the further dissolution of the products of the tearing process is essential.

If the processes are considered further in a utilization phase, the question of design naturally also arises for the best possible use of recycled fibers. Many problems, but also the approaches to solutions for the use of comparatively short fibers, can also be expected to apply to the (multiple) use of mechanically recycled fibers.

Can we speak of upcycling in the final product?

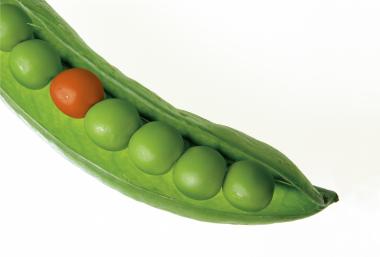

We see yarn-to-yarn recycling neither as upcycling nor downcycling, but as closed-loop recycling. The background is that the products are to go into the same application from which they came and have to compete with primary material. This means that certain specific requirements have to be met and at the same time there is considerable price pressure. In the case of downcycling, a significant reduction in properties is accepted, while in the case of upcycling, the higher-priced application can make up for the reprocessing effort. In the attempt to produce yarn material again from yarn material, both are only permissible to a small extent. This represents the particular challenge.

What does a recyclate prepared from used textiles mean for the spinning process?

Part of this question is to be answered in the project by the detailed classification of the processed fibers and is thus the subject of the tests currently underway. It turns out that, in addition to the rather obvious points such as significantly reduced fiber length, process disturbances due to undissolved fabrics and yarn pieces, there are also less obvious aspects to be considered, such as a significantly increased outgoing quantity for processing in the spinning process. The outgoing quantity is of particular interest here, because in the end the newly produced yarn should also contain a considerable proportion of prepared fibers.

What consequences does this have for textile machinery manufacturing?

The consequences that can already be estimated at the present time are that, particularly in the processing of cotton, the machinery in the spinning preparatory mill is specialized in the processing of (new) natural fibers with a certain amount of dirt. In contrast to new fibers, processed fibers are clean fibers with a significantly higher proportion of short fibers. Elements that are good at removing dirt also reject an increased amount of short fibers, which can lead to unintentionally high waste quantities under certain circumstances. It is therefore necessary to adapt the established machine technology to the new requirement profile of the raw material "processed fibers". Analogous adaptations are probably necessary along the entire processing chain up to the yarn. In the drafting system of the spinning machine, of course, this is due more to the high short fiber ratio than to elements that have been optimized for cleaning out dirt and foreign substances.

Textination GmbH