What is a Virtual Fitting Room? Advantages and Early Adopters

One of the major concerns of online shopping is a consumer’s inability to touch, feel and experience products. This concern is more problematic for fashion products, when the right fit is critical for purchase decisions. Virtual Fitting Room (VFR), a technology that allows consumers to test size and fit without having to try clothing on themselves, eases this concern.

What is a Virtual Fitting Room (VFR)?

A Virtual Fitting Room (VFR) is a function that shows and visualizes a shopper’s outfit without physically trying on and touching items. VFR utilizes Augmented Reality (AR) and Artificial Intelligence (AI). By using AR for VFR, a webcam scans the body shape of shoppers and creates a 360-degree, 3D model based on their body shape.

AI further operates VFR by using algorithms and machine learning to design a full-body 3D model of a shopper standing in front of the camera. A combination of AR and AI technology allows VFR to place items on real-time images as a live video so that customers can check the size, style and fit of the products they’re considering purchasing.

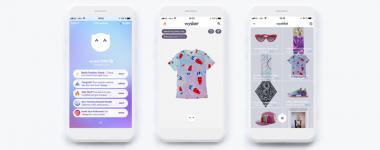

Shoppers can try on clothes and shoes at home without visiting a physical store. In order to do this, customers need to first make sure they have the right settings on their phone. Then, they download a brands’ mobile applications with the Virtual Fitting Room function or visit apparel brands’ websites that support this VFR function and upload a photo of their body shape. Some brands allow a customer to create an avatar using their body shape to test out the fashion items virtually, instead of uploading a photo of themselves.

How does using a Virtual Fitting Room benefit fashion retailers?

- Provides a convenient shopping experience

Research conducted by the National Retail Federation in 2020 stated that 97% of consumers have ended a shopping trip or stopped searching for the item they had in mind because the process was inconvenient.

Shoppers surveyed not only said that in-person shopping was inconvenient but that online shopping felt even more inconvenient to them.

VFR eliminates all of these processes. Shoppers can walk over to the VFR and see what the clothes look like quickly without needing to change them.

- Overcomes the limitations of online shopping

As of 2017, 62% of shoppers preferred to shop at physical apparel stores because they could see, touch, feel and experience products. This was a major problem that online shopping could not overcome.

VFR solves this problem effectively. According to a Retail Perceptions Report, about 40% of buyers said they would be willing to pay more if they could experience the product through AR technology. By incorporating new technologies, VFR makes shopping fun and offers a personalized shopping experience to customers, which can attract more people to online channels.

- Reduces the return rate

High return rates are a big administrative headache for fashion brands. Moreover, it threatens to cut into the profits of fashion brands if they offer free returns. 30% of the return rate in e-commerce fashion shopping is due to purchases of small-sized products, and another 22% happens due to purchases of too large-sized products.

However, VFR alleviates this problem. Whether in store or online, people can check the fit and size of items without having to wear them themselves.

Which brands are already using Virtual Fitting Room (VFR) technology?

Gucci

Gucci is the first luxury brand which adopted VFR. They partnered with Snapchat to launch an augmented reality shoe try-on campaign. It created a virtual lens that superimposed and overlaid a digital version of the shoe on the shopper’s foot when the foot was photographed using a cell phone camera.

Along with the Shop Now button, which guides shoppers to its online store, Gucci achieved 18.9 million Snapchat users and reported positive return on ad spend, which is a marketing metric that measures the amount of revenue earned on all dollars spent on advertising from this campaign.

Otero Menswear

Otero Menswear is a brand focused on apparel for men shorter than 5’10” (1,78 m). Otero added VFR software to its online store to provide perfect fitting sizes to its customers. First, it asks customers four quick questions about their height, leg length, waist size and body type. Then, it offers a virtual avatar corresponding with the answers. Shoppers then use this avatar to see how different sizes of Otero clothing would look on them.

Walmart

In May 2021, Walmart announced that they plan to acquire Zeekit, a virtual fitting room platform, to provide enhanced and social shopping experiences for customers during the pandemic.

When customers upload pictures of themselves and enter their body dimensions, Zeekit builds a virtual body and then customers can dress it accordingly. Customers will simply post their photos or choose virtual models on the platform that represent the best fitting of their height, body and skin tone. Shoppers can even share their virtual clothes with others to get various opinions. Walmart brings a comprehensive and social experience to digital shopping for customers through this acquisition of VFR.

According to research by Valuates Reports, it is expected that sales of the global virtual fitting room market will grow to $6.5 million by 2025. By adopting VFR, consumers will be able to experience convenience in an advanced shopping environment. At the same time, fashion retailers will be able to increase online sales and reduce return rates by offering customers personalized online shopping experiences using VFR technology.

Wilson College Clothing industry Retail digital Online retail virtual try-on Gucci Walmart Otero Menswear

Heekyeong Jo and B. Ellie Jin

This article was originally published by members of the Wilson College of Textiles’ Fashion Textile and Business Excellence Cooperative.